While some countries have decided to slow the development of nuclear energy after the Fukushima crisis, many others, particularly the emerging economies, are still committed to building nuclear power plants to feed their energy demand and drive economic growth.

Nuclear energy got a big boost last month when China decided to resume work on the domestic nuclear projects that were kept in abeyance after the Fukushima disaster.

Nuclear energy got a big boost last month when China decided to resume work on the domestic nuclear projects that were kept in abeyance after the Fukushima disaster.

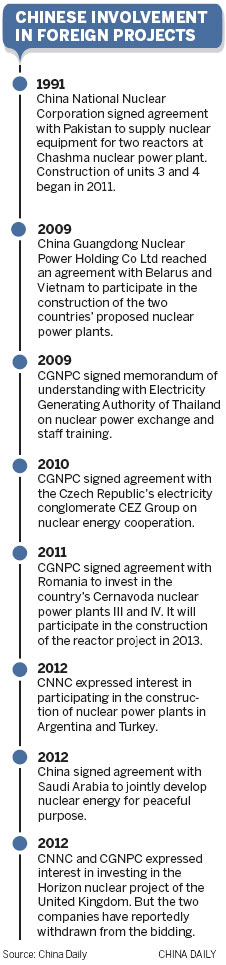

So far, CGNPC has signed agreements with countries like Belarus, Vietnam, Thailand and Ukraine for cooperation on development of nuclear power projects and exploration of uranium mines.

The company also reportedly expressed interest in teaming up with Romania's State-owned company Nuclearelectrica to invest in units 3 and 4 of the country's Cernavoda nuclear power plant.

CNNC, the domestic rival of CGNPC, has reached an agreement with Argentina on the transfer of nuclear reactor technology, for use in two future power plants in the South American country.

Other possible markets for China's nuclear enterprises include Turkey, South Africa and Saudi Arabia, which are all looking to China as potential investors for their proposed nuclear power plants.

"Although China has a booming nuclear industry at home, nuclear power still accounts for less than 2 percent in its overall energy mix. In that sense, the domestic nuclear market is still quite limited and hence it becomes a natural choice for the large State-owned nuclear enterprises to look for opportunities abroad," says Julie Jiang, China program officer at the International Energy Agency.

Analysts say that the potential risk of overcapacity of China's nuclear equipment manufacturing due to massive expansion over the past several years may also prompt enterprises to seek projects overseas.

Charles-Emmanuel Chosson, an energy expert at accounting firm Ernst & Young in France, says that the fast growing nuclear market at home with more than 25 nuclear reactors being built will enable China to develop and reinforce its own nuclear technology and export it abroad.

"China can provide all the necessary equipment needed to construct nuclear power plants and has the ability to build the entire plant, apart from the nuclear island," he says.

The recent success of South Korean energy company Kepco, which won a reactor contract in the United Arab Emirates' nuclear project, shows that it is possible for newer players to enter the bidding competition and be successful with proven technologies, Chosson says.

"While the Chinese solution is still based on the design of second-generation reactors, it may be more competitive than solutions from other developing countries," he says.

China is also providing technical support for the first time in the building of a third-generation nuclear power plant in the United States.

State Nuclear Power Technology Corp Ltd said on Oct 26 that it had signed a technical support service contract with Shaw Power Group related to the building of the Vogtle AP1000 project in Georgia, the first new reactor approved by the US government in nearly 30 years.

The cooperation involves sending Chinese employees to the project over the next four years, with the first batch of six people expected to include planners and electrical engineers, all experienced in building AP1000 projects, commonly known as third-generation reactors.

As the first engineers to participate in the building of a US nuclear power plant, they will not only share their knowledge learned in China, but also gain great experience working on a project outside the country, says Wang Binghua, chairman of State Nuclear Power.

Shaw Group, together with Westinghouse Co, will be responsible for the design, supply and technical support in building reactors No 3 and No 4 at Vogtle, which were approved in February.

The reactors were also the first in the world to get the green light after the Fukushima nuclear crisis in Japan last year. The units will cost about $14 billion and could be operational by 2016, according to a Reuters report.

State Nuclear Power and Shaw Group had initially agreed in April 2009 to support each other in growing the nuclear infrastructure business.

Eli Smith, Shaw Power Group's president and Chief Operating Officer, says his company has been working with State Nuclear Power for a number of years, "so selecting them was easy for us, because of their good reputation".

Besides Vogtle, the two sides area also planning joint bids for other major global nuclear projects, Smith says.

|

|

|

Charles-Emmanuel Chosson, an energy expert at Ernst & Young in France, says China's fast-growing market will enable it to develop its own technology. [Provided to China Daily] |

Domestic auto lineup looks overseas

Domestic auto lineup looks overseas Electric car industry in the slow lane

Electric car industry in the slow lane Brighter days for solar power

Brighter days for solar power Market flat, Japan-brand sales plummet

Market flat, Japan-brand sales plummet