Editor's note: Following the National Bureau of Statistics report on Monday about China's economic performance in the first half of the year, Premier Li Keqiang held a meeting to exchange views with some of the nation's leading economists and business leaders. Several other forums were also held to review the state of the economy.

Many issues were touched upon. For instance, in comparison with the near double-digit growth rate of China's GDP two years ago, is the economy growing too slowly? And in contrast with the short-term need to prevent growth from falling too low, are there some more dangerous long-term problems to tackle?

The following are the opinions from some thought leaders that China Daily collected from those forums.

Aggressive stimulus to blame for slowdown

He Keng former director of the National Bureau of Statistics

To continually step up fiscal expenditure and largely boost investment to maintain growth will no longer be a wise prescription as China's economy is facing headwinds, said a government policy adviser on Tuesday at a forum hosted by the China Center of International Economic Exchanges, a government think tank.

The over-dependence on investment during the last few years led to excessive production capacity and cumulative financial risks, threatening economic growth for a relatively long period, said He Keng, former director of the National Bureau of Statistics.

He described China's second-quarter GDP growth as "stable", and said that the country will not likely see a "hard landing", but that the downside risks cannot be removed in the short run.

On Monday, the NBS said that China's GDP grew 7.5 percent in the April-to-June period.

"The key problem of the decelerated growth is that both domestic and outside demand is lackluster, which is weakening economic development," He said.

He blamed the deepening imbalance of the world's second-largest economy on the aggressive stimulus program of 4 trillion yuan ($645 billion) started in 2008, which he called a "Keynesian-style policy".

"To some extent, (the stimulus package) has destroyed the structure of the national income's primary distribution and depressed the final consumption rate. As wages shrink, domestic demand is getting weaker."

The final consumption rate is the consumption-to-GDP ratio, an important indicator to gauge the health of the country's economic structure.

In the first half, consumption contributed 45.2 percent to the country's GDP, or 3.4 percentage points of the 7.6 percent year-on-year GDP growth. Investment, the biggest driver, contributed 53.9 percent to GDP growth, or 4.1 percentage points, according to the NBS.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

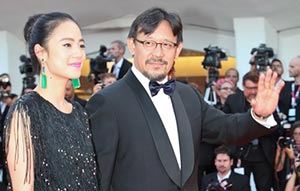

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant