From January to May, fiscal spending increased 13.2 percent year-on-year, well above the 10 percent growth target.

At the current pace, local governments' aggregate deficit this year will total 1.7 trillion yuan ($277 billion), much more than the 1.2 trillion yuan deficit target set in the annual budget.

For the full year, I believe it will be difficult to realize the 8 percent growth target for fiscal revenue.

Fiscal spending will increase more than 10 percent. So, the fiscal deficit will be wider than expected.

The situation demands an overhaul of China's tax and fiscal system.

The near-term reform should focus on reform of fiscal expenditures, and the medium-term reform should emphasize changes in the fiscal system.

In the near term, the government should first refrain from doing things that should be done by the market.

Second, it should reduce tax breaks in some regions, including the western regions, special economic zones and border areas. In particular, I urge the State Council to stop approving tax-break proposals from local governments.

Third, clean up special financial transfer payments, which include too many items and are ill-managed. For example, the direct subsidy for grain is not linked with grain production or productivity.

Fourth, scale back government spending on cars, travel and dining. Establish a more transparent system of budget implementation.

In the medium term, it is essential to address the disparity between local governments' revenue and spending responsibility.

At present, local governments take half of the nation's fiscal revenue but are responsible for 80 percent of the spending. The central government should shoulder more responsibility for social security, some aspects of healthcare and education.

The central government should also shoulder funds that involve cross-regional management.

Local governments' revenue base should be strengthened by changing their major source, which is now land sales, to income tax, property tax and resource tax.

The financial transfer payments system should be reformed. If additional spending responsibility is assumed by the central government, the scale of transfer payments from the central to local governments should be reduced accordingly.

It is also important to streamline special transfer payment items and improve the structure. Many small items that do not have a significant demonstration effect should be scrapped.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

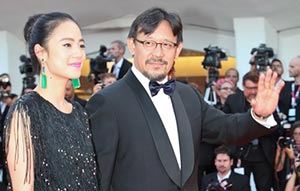

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant