|

|

|

Workers conduct railway maintenance work on a Yangtze bridge in Jiujiang, Jiangxi province. The World Bank cut its 2013 China GDP growth forecast on Monday to 7.5 percent from 8.3 percent in April. Hu Guolin / For China Daily |

China is likely to see fresh speculative inflows of money in the short run, while interest rates are set to be pushed higher through the end of the year, fueled by soaring financing demand from the information technology sector, experts said.

That in turn will spark the movement of cash into the nation, according to a study by researchers at Fudan University.

Sixty domestic bankers, brokers and economists were asked for their economic outlooks for the rest of 2013.

More than 70 percent of those surveyed said that China's foreign-exchange reserves will rise over the next 12 months. For the same period, 88 percent foresee a rise in imports, while just 46 percent see export growth.

Sixty-five percent of the respondents expect China to attract more foreign direct investment, in contrast to 83 percent who forecast a jump in capital outflows.

"These seemingly controversial forecasts suggest that the foreign-exchange reserve expansion can only result from the influx of ‘hot money' instead of longer-term investment," said Sun Lijian, director of the Financial Research Center at Fudan and lead researcher of the report.

Sun said such funds are most likely to move into the equity, currency and commodity markets. However, those fund flows will have a limited impact on inflation, which the survey results said would stabilize at 3.13 percent for the rest of the year.

Financial institutions, including banks, securities houses and financial leasing firms, are poised to benefit the most from higher interest rates, Sun noted, while prospects for traditional manufacturers would be clouded by soaring financing costs, further squeezing margins.

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

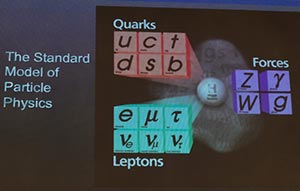

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists

Tibet expected to witness bumper harvest

Tibet expected to witness bumper harvest

Shanghai inaugurates Free Trade Zone

Shanghai inaugurates Free Trade Zone