NEW YORK - AMC Entertainment Holdings, Inc, a movie theater chain operating in the United States and also a

|

|

|

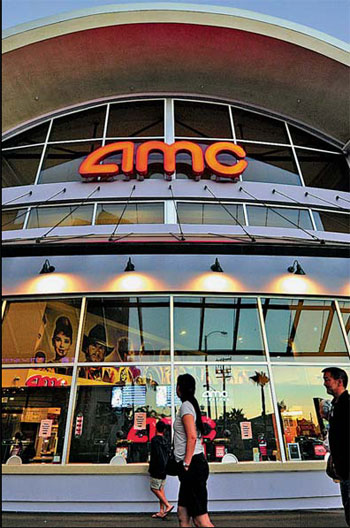

A movie theater of the US cinema chain AMC Entertainment Holdings Inc in Monterey Park, Los Angeles. [Frederic J. Brown / AFP] |

AMC shares began trading at $19.18 per share, 7 percent up from the issue price of $18 per share. Shares closed at $18.90.

The company said in a statement that the fund raised by AMC in the IPO would mainly used to reduce the debt and operate business.

Following AMC's listing, the company's total market capitalization reached $1.868 billion and the Wanda Group holds about $1.46 billion, which surpassed the $700 million of equity investment that was part of the $2.6 billion acquisition price.

"I'm glad to see AMC banners with 'A Wanda Group Company' displayed throughout the inside and outside of the New York Stock Exchange. I believe this demonstrates Wanda's growing influence overseas as China is the biggest culture enterprise," said Wanda Group Chairman Wang Jianlin in a statement.

Mark Otto, managing director at J. Streicher & Co, said the entertainment industry had an excellent performance in the past year and hopefully the IPO would help the company expand business in the near future.

When the Wanda Group acquired AMC in 2012, the movie theater industry was facing considerable challenges in the United States. After the acquisition, the Wanda Group optimized AMC's debt structure through upgrading capital contributions and implementing new management incentive mechanisms, encouraged innovations aimed at improving customer experience.

AMC Entertainment Holdings, Inc, established in 1920, has grown to be a large cinema chain worldwide, with 343 theaters and 4,950 screens. AMC accounts for nearly 20 percent of US box office.

By Sept 30 2013, the company earned revenues of $2.7 billion and net profits of $81.6 million.