Expert calls for careful planning as more enterprises expand abroad

By Jiang Xueqing (China Daily) Updated: 2014-02-28 08:22

|

|

|

Chinese and Indonesian workers are seen at a Chinese-invested mining company in Indonesia's Maluku province. Jiang Fan/Xinhua |

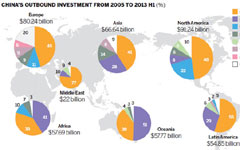

The latest phase of China's economic restructuring is prompting domestic enterprises to invest overseas or carry out foreign mergers and acquisitions.

Channels for foreign investment and financing are increasingly diverse and now extend to emerging markets.

|

|

China's non-financial overseas direct investment reached $88 billion in 2013. It went into 179 countries and regions.

According to Shen Liangjun, deputy director-general of the corporation project appraisal division of the China Development Bank, the risks are particularly high for overseas mining investments.

"Many countries want to maximize the economic and social benefits of their mineral resources, making it difficult for Chinese companies to invest in minerals and causing a 'lose-lose' outcome for both sides," said Shen.

Overseas resource projects may also be affected by investment policy changes, social turmoil, labor policy and other issues, Shen said.

"Chinese investors should fully consider the policies of a country where they plan to invest, including policies on taxation, finance, environmental protection, exports, mining and foreign exchange controls.

"They should also be aware of whether the country has a sound legal system and whether its laws are strictly enforced," said Shen.

Beyond thorough investigation and risk analysis, Chinese companies should pay attention to every detail concerning a project and make contingency plans.

"Some executives in charge of a foreign investment project are too confident. They don't pay enough attention to the details of a project," said Shen.

|

|

|

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday