Luxembourg woos China for yuan business

By Cecily Liu (China Daily) Updated: 2014-03-17 03:16

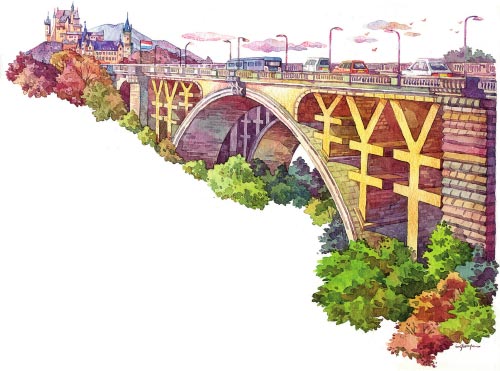

Grand Duchy sets its sights on being European hub for renminbi trade

Although the renminbi has attracted a host of suitors from across the world, it is banking on a small European nation to boost its global standing as an investment currency.

|

|

|

|

"Luxembourg has played a key role in increasing the liquidity of the Chinese currency globally," says Nicolas Mackel, chief executive of Luxembourg for Finance, an agency that works for the development of the financial sector in Luxembourg.

The Grand Duchy, which hosts the European headquarters of three major Chinese lenders, has issued 44 renminbi bonds to date and is home to a growing number of renminbi-focused funds. Unlike London, Frankfurt and Paris, which boast of natural advantages such as bigger trade flows with China and familiarity with investors, Luxembourg is banking on its position as an important investment and finance hub in Europe.

According to sources, cities such as London have not been that popular with Chinese lenders because of the unfavorable environment and strict regulations. London has issued only four renminbi bonds to date, although it had a head start over other cities in Europe.

On the other hand, the big concentration of Chinese banks in Luxembourg has ensured that it has become an important part of China's outbound trade, finance, investment and mergers and acquisition deals in Europe. This has also helped boost the scale and liquidity of the offshore renminbi pool in Luxembourg, sources say.

"Luxembourg's trade with China is tiny. But any currency on its way to being a global reserve currency has to be a trade currency and also an investment currency, which is where we come in," Mackel says.

- Renminbi may become global reserve currency

- HK to offer renminbi services to foreign banks

- Renminbi weakens for sixth day

- Free trade zone is a testbed for renminbi

- A record year for foreign renminbi exchange

- PBOC launches cross-border renminbi services

- Yuan among most-used currencies

- RMB clearing bank in London within sight

- A record year for foreign renminbi exchange

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday