Luxembourg woos China for yuan business

By Cecily Liu (China Daily) Updated: 2014-03-17 03:16

Other European centers such as Paris and Frankfurt have also been growing their renminbi trade settlement and trade finance capabilities.

|

|

|

|

Bernard Poignant, China adviser at Paris Europlace, an organization responsible for coordinating and developing the Paris financial marketplace, says the growing use of renminbi for trade transactions demonstrates "concrete efforts to promote the use of renminbi with French customers dealing with China" by French banks.

"Our goal is to increase the percentage of commercial trade in renminbi. Many small and medium-sized businesses will not know about this option and its benefits if we don't explain it to them," Poignant says.

Poignant's views are echoed by Lutz Raettig, chairman of the supervisory board of Morgan Stanley in Frankfurt, who adds that German banks are working hard to ensure sufficient renminbi liquidity to facilitate the growing renminbi trade flow.

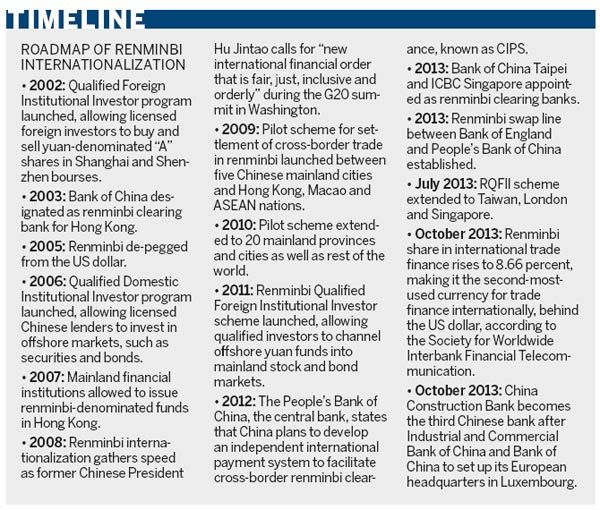

Globally, renminbi usage in international trade finance grew to 8.66 percent in October 2013, from just 1.89 percent in January 2012, according to Society for Worldwide Interbank Financial Telecommunication figures.

This milestone made the renminbi the second-most-used currency for trade finance internationally, behind the US dollar, which has a share of 81.08 percent. About 18 percent of China's global trade is now denominated in renminbi, compared with less than 1 percent nearly four years ago.

- Renminbi may become global reserve currency

- HK to offer renminbi services to foreign banks

- Renminbi weakens for sixth day

- Free trade zone is a testbed for renminbi

- A record year for foreign renminbi exchange

- PBOC launches cross-border renminbi services

- Yuan among most-used currencies

- RMB clearing bank in London within sight

- A record year for foreign renminbi exchange

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday