Living in the lap of luxury

By RIAZAT BUTT (China Daily Europe) Updated: 2015-02-19 15:40

|

|

A man passes Louis Vuitton's advertisement in Wuhan, Hubei province. [Photo / China Daily] |

The numbers swirling around China's luxury sector vary from report to report: Bain has the domestic market contraction at a modest 1 percent rather than Fortune Character's dramatic 11 percent. Nonetheless the two reports reaffirm China's status as a continued source of income for luxury brands, despite an anti-corruption and anti-extravagance drive that has weakened sales of pricey items on the mainland and created a climate hostile to conspicuous consumption and spending.

Analysts at Bain have been studying China's luxury market for seven years. Bruno Lannes, one of its partners, says: "It is all about price. The Chinese are very well informed. They know where the cheapest price is to buy any of these luxury brands."

South Korea and Hong Kong particularly appeal to the Chinese traveler because of their proximity, favorable tax initiatives, competitive exchange rates and cultural familiarity. Chinese visitors to South Korea rose 40 percent in the first 11 months of 2014 to 5.7 million-a 43.5 percent share of arrivals. Hana Daetoo Securities reported in August that Chinese tourists spent just under $6 billion in South Korea in 2013, accounting for 1.9 per cent of total domestic retail spending. The Seoul-based company expects the amount to rise to $29.8 billion in 2020, making up 7.7 percent of the national total.

Other duty free operators are taking a keen interest in the surging "Peking pound". Dubai Duty Free employs 398 Chinese nationals and will employ another 211 this year. A total of 1.35 million Chinese travelers used Dubai International Airport during 2014, representing growth of 9.7 percent from 2013. Chinese passengers comprised around 4 percent of total traffic, while their spending accounted for around $230 million, or 12 percent of total sales. According to Dubai Duty Free, the most popular brands with Chinese shoppers in 2014 were Longines, Chanel, Estee Lauder, Omega and Lancome.

China spent $129 billion on international travel in 2014, says the United Nations World Tourism Organization. A happy coincidence of rising disposable incomes, fewer restrictions on foreign tourism and a currency that has appreciated means Chinese are traveling more and, consequently, spending more than they did 10 years ago.

In the West End of London, Chinese visitors account for more than 20 percent of all tourist spending. "There has been a phenomenal uplift," says Jace Tyrrell, deputy chief executive of New West End Company, which represents 600 businesses in the area. "In 2014, Chinese shoppers accounted for over a quarter of tax-free sales on Bond Street, with visitor numbers from China increasing by 79 percent over the last four years and expenditure rising from 184 million pounds ($284 million; 249 million euros) to 492 million pounds."

Tyrrell puts the popularity of the area down to its cluster of luxury labels already known to the Chinese shopper as well as British heritage brands-such as Asprey and Smythson-that are harder to find in China.

The strength of the relationship between luxury brands and Chinese shoppers is most visible during Chinese New Year (also known as Spring Festival) and Golden Week in October, the weeklong Chinese public holiday around National Day, he says. Bond Street brands have window displays, promotions, limited edition and specially designed products to celebrate Spring Festival.

"Mulberry has the limited edition 'Cara' handbag to represent the Year of the Ram, with eight bags available at the Bond Street flagship," says Tyrrell. He also mentions that big brands do their utmost to make the Chinese customer feel at home, employing Mandarin-speaking staff, offering Chinese tea and training employees in credit card etiquette.

The investment pays off. In February 2014, Chinese sales on Bond Street accounted for 27 percent of the total tax-free spending with an average transaction value of 1,500 pounds. What luxury stores in London offer, says Tyrrell, is a "unique, bespoke experience".

- Stomping good times of stock market

- Living in the lap of luxury

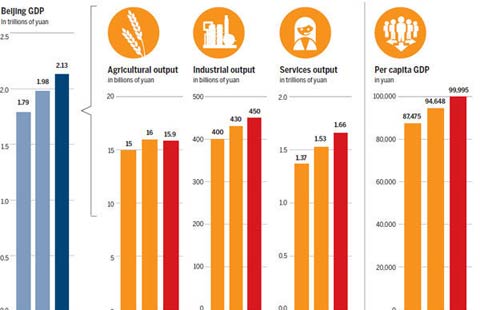

- Infographics: Beijing's goals for the new year

- 42,800 new-energy cars exempt from purchase tax

- Wealth of China's super rich to rise in Year of Goat

- China still darling of intl investors

- Small and simple is fine, but glitter remains key

- Mainland's gold imports from HK tumble 32% in 2014