Living in the lap of luxury

By RIAZAT BUTT (China Daily Europe) Updated: 2015-02-19 15:40

|

|

Chinese people buy luxury products at a duty free store in Seoul. [Photo / China Daily] |

It is not just overseas retailers that are snapping at the heels of China's high-end boutiques, it is overseas e-tailers too. New York-based Gilt sells heavily discounted designer items over a restricted period. Marshall Porter, senior vice-president and general manager of international at the US firm, says: "We've had the Chinese-language site for almost six months. The navigation is in Chinese and so is the checkout. We're trying to create a site that is seamless for the cross-border Chinese shopper."

Porter describes Gilt's Chinese customer as a savvy female who is luxury-oriented, aged 25 to 40. "Brands that are popular with Chinese customers are contemporary luxury ones-Swarovski, Kate Spade-but we sold a Hermes Birkin bag to a Chinese customer for $19,000. Price and authenticity convinces Chinese people to shop on overseas sites. There is clearly a trend in that direction-knowing they can get these products at lower prices and products that are assured." Some Chinese on and offline retailers have a reputation for selling counterfeit items, he says.

According to Fortune Character Institute, fake luxury products in China outnumber genuine items by six to one. A quick tour of Hongqiao and Silk Street markets in Beijing reveals multiple stalls selling bags, belts, cufflinks and watches that are, to the untrained eye, passable copies of the real thing. Tina Zhou, of the institute, says there are too many fake products for brands to deal with.

"These fakes find their way onto e-commerce platforms, even boutiques in second- and third-tier cities. Brands don't have the energy to get rid of these fakes. That is another reason for Chinese people buying in Paris and Milan-they know they are buying the real thing, from the source."

But brands should not lose faith in China, says Liz Flora, who edits Jing Daily, an online magazine about China's luxury sector. "It's vital that stores have a brick and mortar presence in China. They want to create that brand awareness so the Chinese customer is aware of it when they go abroad. Many Chinese consumers like to see a product before they buy it. They want to learn about the quality. It's also important to make sure that the service is on a par with the global service. The perception is that the service is better in Hong Kong and overseas. Many Chinese consumers are jetsetters. If the Chinese have a good experience with the brand abroad and are treated really well, they will take that back with them."

A survey by the public relations firm Ruder Finn supports the perception of Chinese mainland stores offering poor service. Of the 1,616 people interviewed for its China Luxury Forecast 2015, 19 percent said they were very satisfied with service received on the mainland. The top sources of dissatisfaction were limited product selection, unknowledgeable staff and brands relying too heavily on celebrities.

Alain Li is regional CEO of Richemont APAC, which owns several luxury brands including Cartier, Montblanc and Van Cleef & Arpels. He says the company experienced healthy growth in China before 2014. However, last year was the first time they saw a decline in the Chinese market, mainly affected by the rise of overseas shopping agents, as well as the exchange rate.

As a result of the new climate, Li says, Richemont is focusing on the "globalization of services" and is attaching more importance to training Chinese staff to provide the same standard of service found elsewhere in the world.

Fang Jinqi, a Shanghai real estate agent, speaks of the convenience of shopping overseas, with stores accepting China UnionPay and employing Chinese-speaking staff members. The 32-yearold frequent flier went to Japan, South Korea and Canada last year. There is usually no budget for her purchases as she hails from an affluent family.

"My favorite shopping items were Christian Louboutin's high heels. Some of their shoes, which are limited edition, may cost over $30,000 per pair. But it is really worth the money for my future (shoe) collection. Sometimes, I will also buy cosmetics for my friends and relatives. But my friends all travel a lot themselves."

Shi Jing contributed to this story.

- Stomping good times of stock market

- Living in the lap of luxury

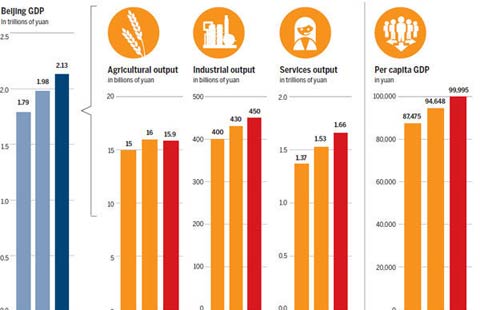

- Infographics: Beijing's goals for the new year

- 42,800 new-energy cars exempt from purchase tax

- Wealth of China's super rich to rise in Year of Goat

- China still darling of intl investors

- Small and simple is fine, but glitter remains key

- Mainland's gold imports from HK tumble 32% in 2014