With the London Olympic Games drawing near, Chinese Internet companies, mainly Web portals and online video providers, are gearing up to cash in on the event.

Market players have been trying to attract both users and advertisers by making self-produced Olympics-related programs, increasing content on mobile devices, and taking advantage of micro-blogging services.

Sohu.com Inc and Tencent Holdings Ltd, two of the largest Internet portals in China, plan to provide about 10 self-made video programs, including those that invite celebrities to go to London to introduce the city.

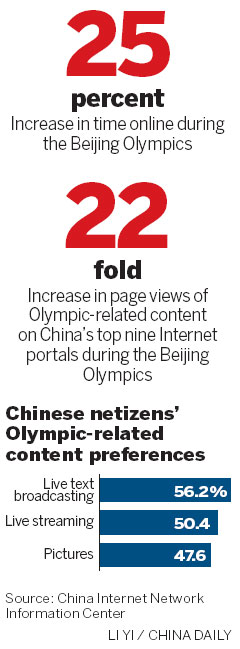

Compared with the Beijing Olympics Games in 2008, Sohu has increased its efforts to make programs of this kind to distinguish itself from competitors, said Zhang Yi, director of the sports channel of Sohu.

It will also release its mobile application for the Games in July, apart from its already existing Sohu news application, which has 6 million daily active users.

Although advertisers showed greater enthusiasm for the 2008 Games than they have for the 2012 Games, their interest in ways to advertise on mobile devices has been increasing, said Zhang.

Baidu Inc, the country's top Internet search engine, initiated its Olympic strategy last year when the company upgraded some of its online products to provide better service to advertisers this summer. It teamed up with large advertisers such as Unilever NV and Procter & Gamble Co and said it will launch a series of Olympics-related marketing campaigns for advertisers.

"The Olympics are an indispensable marketing opportunity for advertisers, and we will provide different kinds of services to our customers," Baidu said in an e-mail to China Daily.

Other players, such as major Internet portal Netease.com Inc and PPStream Inc, an online television provider, will also provide services through mobile devices.

In 2011, Chinese users spent an average of 110 minutes each day on their mobile applications, close to the 114 minutes they spent online with their personal computers, Xu Shi, general manager of NetEase's Mobile Internet Center, said in February when introducing the company's Olympic strategy.

About 356 million Chinese had visited the Internet via mobile devices by the end of 2011, according to the China Internet Network Information Center.

Micro-blogging services, which are enjoying increasing popularity in the country, have also been what market players aim to cash in on during the Olympic Games.

Tencent, which competes with portal Sina Corp, especially in the micro-blogging field, has gained exclusive access to interview 90 percent of the Chinese medal-winning teams on its micro-blogging service.

Wang Yongzhi, deputy editor of Tencent.com, said the company will spend hundreds of millions of yuan on the Olympic project, mainly on servers and bandwidth, exclusive rights for interviews, and self-made content, according to newspaper National Business Daily.

Broadcast rights

In 2008, a number of online video companies purchased live broadcast and on-demand broadcast rights from State-owned online TV station, China Network Television, or CNTV.

The companies were able to attract the attention of users, but at the same time spent a lot of money on rights.

"In 2008, the revenues we generated from the event were about 20 percent of the cost," said Xu Weifeng, president of PPStream.

The company has been in talks with CNTV, which has broadcast rights of the Games on the Internet this year.

However, Xu said it is not known whether a deal could be reached between the two as the cost for the purchase is at least 20 million yuan, and it's difficult for companies to make ends meet in the Olympics Games projects if they purchase the rights.

Sohu and Netease have bought rights from CNTV, including those for the opening and closing ceremonies, and other matches. Neither company elaborated on how much they spent to purchase the rights.

CNTV will broadcast 5,600 hours of Olympic events live this year, it said.

History showed that operating expenses during the Olympics may be heavy enough to offset online media earnings.

Sina Corp, the nation's top Web portal, reported that its advertising revenues were $76.2 million in the third quarter of 2008, when the Games were held in Beijing. Although this represented a 17.4-percent quarterly increase, higher operating expenses reduced its net income to $22 million, a decrease of 13 percent from the previous quarter.

Sohu, an official sponsor of the Beijing Olympics, also reported a decrease of 2 percentage points in growth margin in the third quarter of 2008, and the operating margin of Tencent decreased to 40 percent from 47.8 percent the previous quarter.

"Generating profit is only a part of our Olympic strategy ... we need to test new marketing products through this big event," said Baidu, adding that the investment during the Olympics may be paid back if the advertisers are satisfied with the marketing results.

Contact the writers at chenlimin@chinadaily.com.cn and gaoyuan@chinadaily.com.cn

(China Daily 06/27/2012 page15)

Market in Zhejiang uses Alipay for convenience

Market in Zhejiang uses Alipay for convenience

Bus decorated with 3D painting goes into service

Bus decorated with 3D painting goes into service

Top 10 tire companies in the world

Top 10 tire companies in the world

Drone training schools turn hot in China

Drone training schools turn hot in China

China-Arab States Expo concludes on Sunday

China-Arab States Expo concludes on Sunday

Top 5 best-selling wearable devices brands

Top 5 best-selling wearable devices brands

China-ASEAn Information Harbor Forum kicks off

China-ASEAn Information Harbor Forum kicks off

Audi's new S7 Sportback and A7 family

Audi's new S7 Sportback and A7 family