|

|

|

|

|||||||||||

|

Xie Xuren, minister of finance, gives a news conference on the country's financial policies and financial work on the sidelines of the Fifth Session of the 11th National People's Congress in Beijing on Tuesday. [Photo / China Daily] |

Proactive fiscal policies will continue playing a vital part in supporting the development of smaller businesses, despite a slowdown in fiscal revenue growth, China's Finance Minister Xie Xuren said on Tuesday.

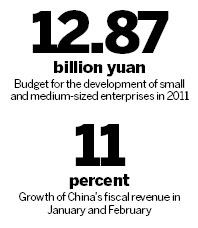

There was 12.87 billion yuan ($2 billion) invested in development for small and medium-sized enterprises, and the support will continue to expand this year, Xie said at a press briefing in Beijing during the National People's Congress.

This year will see more structural tax reform, such as an extension of a trial system in Shanghai that replaces sales tax with value added tax to avoid duplicate taxation, as well as a "larger amount of special funding to support technical upgrades for small and micro companies", Xie said.

The minister also called for an end to irregular administrative surcharges by local governments, and for better mechanisms to protect companies' rights.

However, Xie revealed that the growth of China's fiscal revenue had slowed to 11 percent in the first two months of this year, while tax revenue alone only increased by 8 to 9 percent.

The total annual fiscal revenue growth in 2011 soared to 24.8 percent year-on-year.

"The rapid growth of fiscal revenue in recent years was based on increasing profits by companies, as well as being affected by inflation factors," Xie said, adding that higher prices contributed about 10 percent to tax revenue last year.

To solve the funding shortage faced by many SMEs, Xie said, the government is studying "policies to foster healthy development of the financial guarantee sector to allow more credit aid from finance institutions to smaller businesses".

"There is also a development fund to encourage venture capital and other social funds to increase their support for small and micro enterprises," he said.

A series of other tax reforms are also under way to facilitate the transformation of the country's economic structure.

Xie said the government is studying "expanding the scope of its property tax trials", which have been implemented in Shanghai and Chongqing since the beginning of last year.

"Property tax can lead to a reasonable housing demand as well as adjusting the imbalance in income distribution," Xie said.

But he did not say in which cities the trial would be extended.

Xie also demanded that local governments should coordinate their financial resources and set up local funds to effectively repay debts, which totaled 10.7 trillion yuan in late 2010.

There also should be "different treatments for projects under construction according to their importance. And follow-up financing for the priority projects should be guaranteed," he said.

Structural tax cuts, a major part of fiscal policy this year, were applauded by many entrepreneurs.

Li Dongsheng, chairman of TCL Corp and an NPC deputy, said more tax cuts and less administrative charges will help businesses through a tough time as well as bring down inflation.

Li suggested that if the government were to refund income tax paid on reinvestment in development, it would encourage companies to improve innovation.

As for administrative charges, "some of these were introduced when the government budget was tight. But as fiscal revenue growth has been restored, it's totally feasible to put them into the government's budget system", he said.

weitian@chinadaily.com.cn