Credit union proves engine for prosperity

By Gao Changxin and Yang Jun in Guiyang (China Daily) Updated: 2012-11-16 09:58Local co-op enjoys better loyalty than 'Big Four' banks in Guizhou market

The dominance of the "Big Four" banks is unshakable in most parts of China - but in Guizhou, a largely underdeveloped province, they are still far behind a local market leader in inspiring loyalty.

Even combined, the deposits of the Big Four - Industrial and Commercial Bank of China Ltd, China Construction Bank Corp, Agricultural Bank of China Ltd and Bank of China Ltd - are not much bigger than those of Guizhou Rural Credit Union, a credit cooperative which alone owns 21 percent, or more than 200 billion yuan's ($32.06 billion) worth of the province's total deposits of 1 trillion yuan so far this year.

Just a decade ago, the rural cooperative had just a few billion yuan in deposits, but it's in lending that the organization has gained the most support.

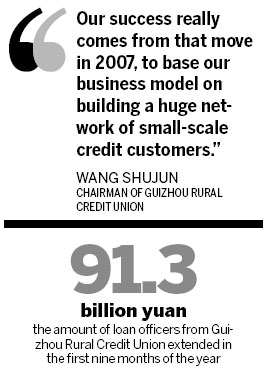

Its growth, said Chairman Wang Shujun, has gained most from a new business model introduced in 2007, which concentrates on low-risk, micro-loans to low-income local people, mainly farmers - which is ideal for a province where 80 percent of the population works in the agricultural sector.

"Our success really comes from that move in 2007, to base our business model on building a huge network of small-scale credit customers," said Wang in an interview.

Launched with the initial purpose of trimming its bad loan ratios, which were around 30 to 40 percent at the time, the cooperative started providing credit to local farmers - a step that has proved financially sensible, but also politically too, he said.

Today, its local loan book is among the country's most comprehensive and extensive, covering 95.8 percent of the province's 7.8 million farmer households.

Despite the obvious risks, its bad loan ratio is in the single digits, Wang added.

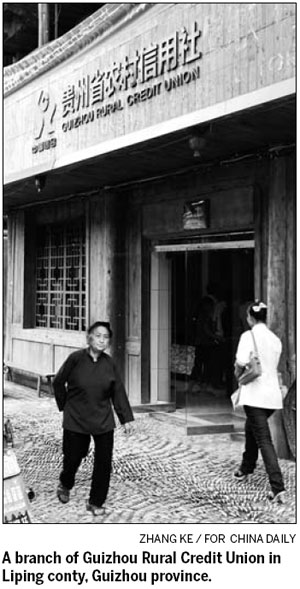

The lender has 2,244 outlets across the province, giving it a presence in most villages and townships.

Each outlet employs loan officers who are responsible for setting up and updating its customers' credit files.

Wang explained that an essential part in managing those individual credit files, is that loan officers work hand-in-hand with local government officials in closely examining farmers' creditworthiness. This strong government support, he said, makes it hard for local farmers to hide dishonesty.

In addition, the lender hires unofficial personnel to help with updating its credit files - usually village elders and senior citizens who have substantial local influence.

Each family is given a credit rating that affects the size of the loan they get and its conditions. Each family's credit rating, which has four levels, is a combination of ratings given by loan officers, local governments and their neighbors.

Jin Zhucheng, a loan officer in the credit union's Leishan county branch, explained how the credit files - which he calls the lender's "core asset" - are kept accurate and up-to-date. "Most of my job involves going into villages and talking to farmers," said Jin, who is from the Miao ethnic group, like many in the local population.

"Thanks to the help of local officials and our unofficial helpers, we know, for instance, if a couple has recently had a fight, or their son has broken up with his girlfriend."

- Danish company invests millions to curb pollution

- B20 summit to focus on global growth

- Australia says to benefit from China's economic development

- China's SoundCloud-esque Ximalaya valued at $623 million

- China's outbound direct investment surges in Jan-May

- Border trade booms along southwestern Chinese border

- Possible merger between Didi and Uber in China

- FIBA joins Wanda to spread basketball's reach