Is China losing competitiveness or moving up value chain?

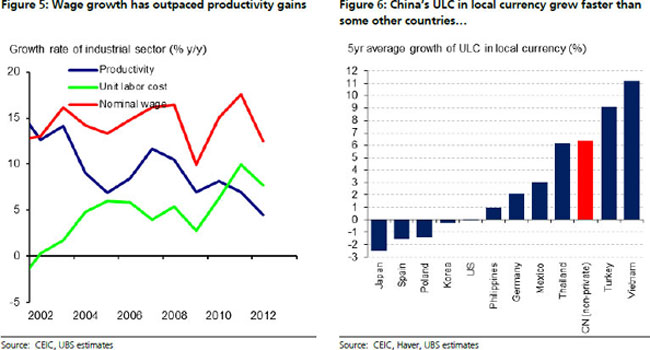

By Wang Tao and Harrison Hu (chinadaily.com.cn) Updated: 2014-03-28 18:18Of course, what truly matters is unit labour costs (ULC), not nominal wage levels. Since labour productivity varies a great deal across countries, comparing wage levels across countries could be misleading. Similarly, since wage growth is often accompanied by labour productivity improvement, changes in underlying labour cost should be measured by growth in ULC, as that is what really matters for corporate profitability. Because of rapid growth in labour productivity in China, in part thanks to better equipment and technology as well as better infrastructure associated with increased investment, ULC has risen more moderately despite the double digit wage growth (Figure 5).

In the past few years, however, labour productivity improvement moderated along with economic growth, but wage growth continued at a fast pace, partly due to the changing demographics and structural issues in the labour market. As a result, unit labour cost grew faster than in the previous decade as well as some other countries (Figure 6).

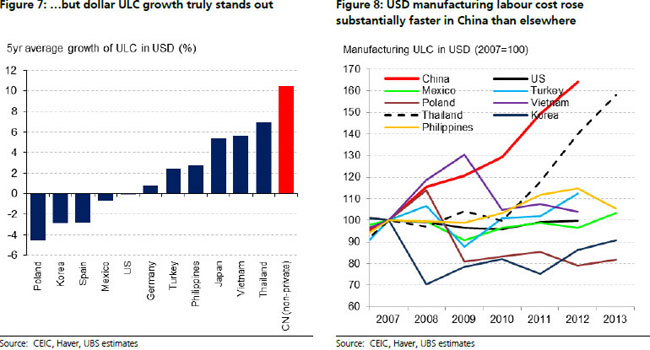

The contrast between China and trading partners becomes very large when we compare ULC growth in US dollar terms (Figure 7). Steady growth in ULC coupled with the appreciation of the RMB has led to a substantially faster increase in dollar-denominated labour cost in China than most other economies. We estimate that China's dollar ULC has grown by more than 60 percent since 2007, when its current account surplus peaked at 10 percent of GDP. Such a rapid climb dwarfs that in developed economies and key competitors such as Korea, Mexico and Vietnam and only Thailand comes close (Figure 8).

- RMB internationalization could transform global markets

- Yuan enters new era with freer float

- Yuan fluctuation was not engineered, economist says

- China remains important global economic driver

- CICC expects China GDP to grow 7.3%

- ADB has confidence in Chinese economy

- China on new growth track within 2 years

- NHTSA says finds no 'defect trend' in Tesla Model S sedans

- WTO rare earth ruling is unfair

- Amway says 2014 China sales may grow 8%

- President Xi in Europe: Forging deals, boosting business

- CNOOC releases 2013 sustainability report

- Local production by Chery Jaguar Land Rover this year

- Car lovers test their need for speed in BMW Mission 3

- China stocks close mixed Monday