11.11: Winning formula for a global phenomenon

Updated: 2013-11-13 07:18Glamour Sales, the shopping portal selling the likes of Armani jackets and Valentino bags, attracted the attention of its 2.5 million registered members with various discounts, said Thibault Villet, chief executive officer of Glamour Sales China.

Nevertheless, Alibaba's first-mover strategy had the company sitting firmly in the driver's seat, said Zheng Liang, director of e-commerce for research firm Nielsen in China.

"The Nov 11 event has ballooned into a flagship event under the Alibaba brand, so that consumers and vendors alike tend to prioritize their choices at Taobao and Tmall instead of on other e-commerce platforms," he said, adding that the more diversified portfolio of Tmall and Taobao is also a winning recipe for Alibaba.

While people benefited from the event, the deal of the day belonged to Alibaba, thanks to its unique business model, Zheng said.

Alibaba, as opposed to self-run businesses, operates third-party platforms that bridge retail brands with shoppers, and generates profit largely from commissions and advertising.

While price wars took sales to new heights, they also pushed certain firms into the red. For instance, online clothing vendor Vancl's goal to become profitable was jeopardized by a recent scandal, with some suppliers alleging that the company breached payment contracts.

By contrast, Alibaba, unlike its rivals who hold or deliver stock, is insensitive to profit fluctuations, Hong said.

"It's safe to say that the large-scale promotions only reinforce the dominance of Alibaba's online marketplaces, leaving sellers to do the heavy lifting," Hong said.

Medium-sized and small merchants did express mixed feelings about the promotion, given that the deluge of orders posed heavy burdens on their operational capabilities, even as discounts severely cut into their profits.

The expanded pot failed to translate into exploding customer traffic for skincare brand Naruko's Tmall shop, with sales growing only modestly, from 24 million yuan a year ago to 29.5 million yuan this year.

"A lot more merchants joined the promotion this year, so it inevitably diluted our customer flow," said Chen Chao, public relations manager for Jollywiz Digital Technology Co Ltd, a franchised online reseller of Naruko products.

"We view 11.11 from its ability to attract new customers, and in that sense, it has great value. Every year after 11.11, our customer base increases to a whole different level," she said.

The Lian Trade Co, a designated reseller of Japanese skincare products, did not meet its sales goal during this year's event, said Xu Liang, the company's general manager.

While acknowledging the event as an influential market campaign, Xu expressed concerns that Alibaba may favor more heavyweight players as they settle at Tmall, putting smaller-cap shops at a disadvantage.

"Tmall is indeed the biggest online player, but we may leave our choices open next year," said Chen, inferring there are possibilities they may team up with other online partners.

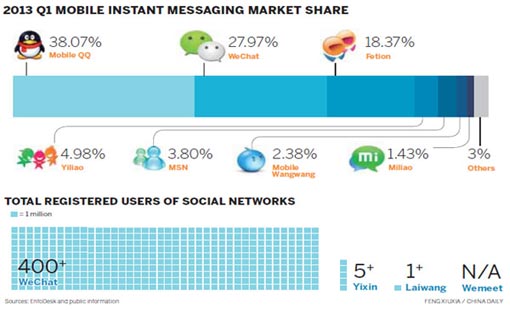

Zheng from Nielsen identified yet another challenge for Alibaba's monopoly: the mobile Internet.

"While smart device payments jumped significantly compared with last year, it is an open secret that Alibaba has, in effect, missed its earlier-set target of 8.8 billion yuan for mobile transactions, " Zheng said.

Alibaba is struggling to champion the success of its PC terminal for portable devices, with active access points significantly lagging behind that of Tencent Holding Ltd's WeChat, Zheng said.

"As the mobile Internet is set to reshape e-commerce in the short run, it's hard to predict what the landscape may be like in just one year," he said.

Xu Junqian in Shanghai contributed to this story.