|

|||||||||||||||

|

|

Major Macro Economic Statistics

|

||||||||||||||

| Growth indexes | Price indexes | ||||||||||||||

| Industrial output: +13.3% | CPI: +5.1% | ||||||||||||||

| Retail sales: +18.7% | PPI: +6.1% | ||||||||||||||

| Fixed-asset investment in Jan-Nov: +24.9% | PMI: 55.2% | ||||||||||||||

| FDI: +38.17% | Housing prices:+7.7% | ||||||||||||||

| Financial indexes | Foreign trade indexes | ||||||||||||||

| New loans: 564b yuan | Import: +37.7% | ||||||||||||||

| M2: +19.5% | Export: +34.9% | ||||||||||||||

| Fiscal revenue: +16.1% | Trade balance: $22.9b | ||||||||||||||

|

CHINA ECONOMY BY NUMBERS (Monthly Issue)

|

|||||||||||||||

| January | February | March | |||||||||||||

| April | May | June | |||||||||||||

| July | August | September | |||||||||||||

| October | November | December | |||||||||||||

| Data and Graphic | |||||||||||||||

|

|

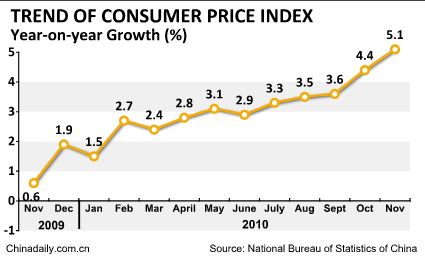

China's Nov CPI up 5.1% China's consumer price index (CPI), a major gauge of inflation, rose to a 28-month high of 5.1 percent in November, the National Bureau of Statistics (NBS) said. The inflation was driven by a 11.7 percent of surge in food prices, which accounts for one third of the basket of goods used to calculate China's CPI.[Full story] |

||||||||||||||

|

|

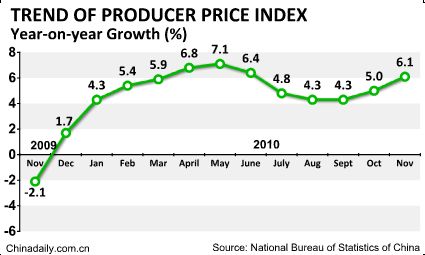

China's Nov PPI up 6.1% The producer price index (PPI) for China's industrial products rose 6.1 percent year on year in November, compared with a 5.0 percent gain in October.[Full story] |

||||||||||||||

|

|

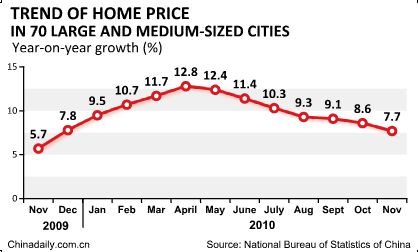

China's Nov property prices continue to rise Property prices in 70 major Chinese cities rose 0.3 percent in Nov month-on-month and 7.7 percent year-on-year, the National Bureau of Statistics (NBS) said. The annualized growth rate, which peaked at 12.8 percent in April, was down from an 8.6 percent increase in October, and fell for the seventh consecutive month after the government began stepping up controls to curb prices in April.[Full story] |

||||||||||||||

|

|

China's industrial output up 13.3% China's industrial value-added output year-on-year growth quickened to 13.3 percent in November from 13.1 percent in October, the National Bureau of Statistics (NBS) said on Dec 11. The growth rate for the first 11 months was 15.8 percent year-on-year, down 0.3 percentage points from the January-to-October period, the NBS said. [Full story] |

||||||||||||||

|

|

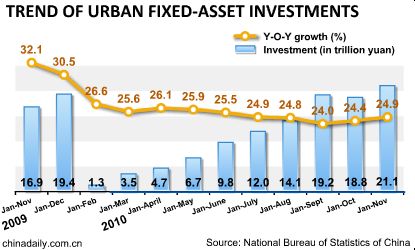

China's urban fixed-asset investment up 24.9% China's urban fixed asset investment rose 24.9 percent in the first 11 months year-on-year to hit 21.07 trillion yuan ($3.19 trillion), China's statistics authority said on Dec 11. The growth rate was 0.5 percentage points higher than that during the first ten months, according to figures released by the National Bureau of Statistics (NBS).[Full story]

|

||||||||||||||

|

|

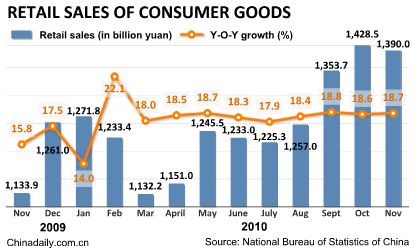

China's Nov retail sales up 18.7% China's retail sales of consumer goods grew 18.7 percent in November year-on-year, the National Bureau of Statistics (NBS) said on Dec 10. Retail sales of consumer goods stood at 1.39 trillion yuan ($208.1 billion) in November and the growth rate was 0.1 percentage points higher than that in October, the NBS spokesman Sheng Laiyun said at a press conference.[Full story] |

||||||||||||||

|

|

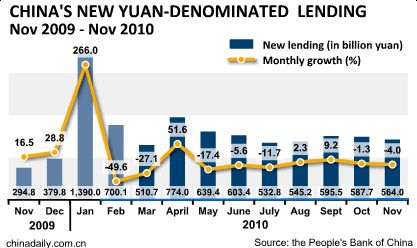

China's new yuan-denominated loans in Nov reach 564b yuan New yuan-denominated lending in China in November dropped to 564 billion yuan ($84.8 billion) from 587.7 billion yuan in October, the People's Bank of China (PBOC), China's central bank said. The new lending was 269.2 billion yuan more than the lending in November last year. [Full story] |

||||||||||||||

|

|

China's trade surplus hits $22.89b in Nov China's export growth accelerated in November in a possible sign global demand is recovering, government figures showed. Exports jumped 34.9 percent from a year earlier to $153.3 billion, boosted by a surge in sales to other developing economies, which are recovering faster than the United States and Europe from the global crisis. [Full story] |

||||||||||||||

|

|

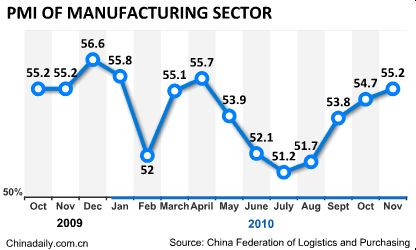

China's PMI of manufacturing sector rises to 55.2% in Nov The Purchasing Managers Index (PMI) of China's manufacturing sector rose to 55.2 percent in November, up 0.5 percentage points from October, the China Federation of Logistics and Purchasing said Wednesday. [Full story] |

||||||||||||||

|

|

China's Nov fiscal revenue grows 16.1% China's fiscal revenue rose 16.1 percent year-on-year to 584.07 billion yuan ($87.7 billion) in November, the Ministry of Finance announced. [Full story] |

||||||||||||||

|

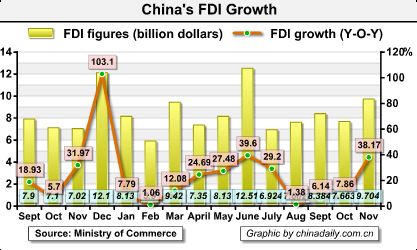

China's FDI up 38.17% in November

Foreign direct investment (FDI) into China rose for the 16th consecutive month to hit $9.704 billion in November, indicating that China remains a favored investment destination. [Full story]

|

||||||||||||||

| Round Table | |||||||||||||||

|

A shift to a "prudent" monetary policy heralds the adoption of necessary measures to restrict excess liquidity next year and an attempt to keep the proportion of circulating money volumes to a moderate level. The move will help drive national economic growth and rein in inflation and the rapid rises in property prices. Full Story] |

Financial power is related directly not only to economic size and per capita GDP, but also to financial markets and financial industries. Only when China's financial markets become open and its financial sector stronger, can the country increase its financial power significantly. To some extent, financial power is largely reflected in the confidence attached to a country's monetary system. [Full Story] |

||||||||||||||

|

Governments around the world are trying hard to stimulate consumption to propel economic growth. For China, it is also the means to move away from an excessively export-dependent economy and help rebalance the world economy. All these may make economic sense. But it does not make environmental sense at all. [Full Story] |

China vowed to increase efforts to combat inflation while maintaining "stable and relatively fast" economic growth.

|

The country's future macroeconomic policy should focus on how to rein in inflation by controlling liquidity and monetary supplies. The country should moderately tighten its monetary policy through properly utilizing interest rates and reserves in a bid to optimize its resources distribution in the capital market. [Full story] |

|||||||||||||

|

Louis Kuijs, a senior economist at World Bank Office in Beijing. The recent rise in China's inflation has grabbed the attention of the public and policymakers alike. Consumer price inflation rose to 4.4 percent in October and a further increase is expected. This is higher than we are used to in China, although it is modest in an emerging market perspective. To determine the best policy response to the rise in inflation it is important to know its cause and how much inflation we should expect in the coming 12 months. It is also good to decide what an acceptable rate of inflation is for a country like China. [Full story] |

Binod Singh, a teacher at Beijing Foreign Studies University. Since the 2008 food price explosion across the developing world, prices have hardly come down to pre-crisis levels. The infusion of liquidity in global markets by printing currencies and pumping it into financial markets has proved disastrous for many developing economies such as India and China. The quality of life for people in rural areas is deteriorating because they cannot buy the basic necessities, even paying double from just a year ago. Consequently, there is a strong sense of growing dissatisfaction among the masses in developing countries against the so-called GDP rise and oppressive inflation rate. [Full Story]

|

||||||||||||||