Xiaomi eyes big Indian prospects

By MA SI (China Daily) Updated: 2016-10-20 08:16

|

|

Lei Jun (left), founder and chief executive officer of Xiaomi, and Hugo Barra, Xiaomi's vice-president of international operations, display Mi 4i phones during the launch in New Delhi. [Photo/Reuters] |

Smartphone vendor sets sights on move to snap up biggest slice of nation's lucrative and huge market

Xiaomi Corp aims to become the largest smartphone vendor in India over the next three to five years, after it sold more than 1 million handsets within 18 days in the world's fastest-growing handset market.

The announcement came shortly after its arch rival Huawei Technologies Co Ltd confirmed it would start assembling phones in India in October. This highlights Xiaomi's latest efforts to revive declining sales as the Chinese smartphone market-its home turf-is reaching saturation.

Lei Jun, founder and CEO of Xiaomi, announced the news in an internal letter on Wednesday.

"India is an extremely important market in Xiaomi's globalization strategy," Lei said. "It has become our largest market outside of the Chinese mainland."

According to Lei, as of Tuesday, the Beijing-based firm had sold 1 million smartphones within 18 days in October in the run-up to Diwali, the biggest festival in India.

In September, Xiaomi became the third-largest smartphone vendor within India's top 30 cities with 8.4 percent market share, the firm quoted data from International Data Corp as saying.

"We will continue investing in India-expanding our supply, and further improving our after-sales service," Lei said.

Launched in 2010, Xiaomi achieved a rapid rise by seizing the e-commerce boom in China to sell handsets directly to consumers.

But as online sales of smartphones peak, it is struggling with declining sales and facing mounting pressure from rivals such as Oppo and Vivo.

Jin Di, a research manager at International Data Corp China, said it is hard to say whether Xiaomi can prevail in the Indian market, given the growing competition from both its Chinese peers and Indian vendors.

"Almost every major Chinese smartphone brand is eyeing a presence in India. I don't think Xiaomi has a big edge, especially when India's e-commerce business, which Xiaomi is most good at, is not as well-developed as that of China," Jin said.

Also, it will take time for Chinese brands to properly localize their operations, given the different business environments and polices in India and China, she added.

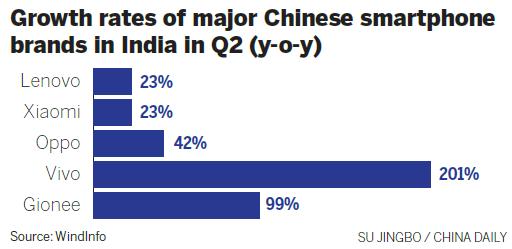

In the second quarter of 2016, smartphone shipments in India grew by a healthy 15 percent annually, while the global smartphone market grew at a modest 3 percent. Chinese brands' captured almost 27 percent of the Indian market, data from Counterpoint Research show.

Xiaomi's arch rival Huawei said on Tuesday it would start manufacturing its first smartphone model in India in October by partnering with a local factory whose annual production capacity will reach 3 million units by the end of 2017.

Zhao Ming, in charge of smartphone business at Honor, the sub-brand of Huawei, said: "The India smartphone market is likely to exceed 100 million units this year. It is a market no one can neglect. We have long-term commitment to it."

- China Life invests in Starwood hotels

- Alibaba, Suning to set up e-commerce firm

- Xiaomi eyes big Indian prospects

- Intelligent robots interact with audiences at Beijing AI expo

- Consumption growth called key

- Stability for yuan seen in long run

- Real estate faces uncertainty, experts say

- Samsung to face lawsuit for Note 7 inconvenience