|

|

|

|

|||||||||||

May be lower in future than 7.5 percent set for this year

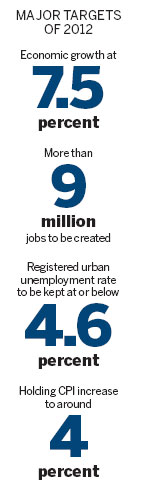

The economic growth target could be lowered further in the coming years after it was set at 7.5 percent for 2012.

The target, the lowest in eight years and down from last year's 8 percent, signaled what analysts said were efforts to restructure the economy by boosting domestic consumption and making growth more sustainable.

China will also continue to press on with reforms to "break the bottleneck of development", said Premier Wen Jiabao as he delivered the government work report at the opening of the annual parliamentary meeting on Monday.

|

|

|

Premier Wen Jiabao returns to his seat after delivering the central government report on Monday to the National People's Congress. [Wu Zhiyi / China Daily] |

Adjusting the growth target is in line with the 12th Five-Year Plan (2011-15) as it seeks "higher-level, higher-quality development", Wen said, referring to the 7 percent target set for the period.

"The target could be further reduced near the end of the 12th Five-Year Plan," said Jia Kang, director of the Finance Ministry's Fiscal Science Research Center. The lower target puts the focus more on restructuring the economy, he said.

|

|

Li Daokui, policy adviser for the central bank and director of the Center for China in the World Economy at Tsinghua University, also forecast a lower growth target. "The 7.5 percent target for this year is reasonable," he said.

The MSCI ACWI Index, which monitors the equity market performance of both emerging and developed world markets, fell for a second day. The benchmark Shanghai Composite Index dropped 0.64 percent at the close.

"It's of symbolic importance in signaling a greater focus on the quality, rather than quantity, of growth," World Bank Lead Economist for China Ardo Hansson said.

China has been striving to change the structure of an economy that is highly dependent on exports and investment. The goal is to boost domestic consumption.

The new target "will encourage authorities to see if they can stimulate domestic consumption as a counterbalance to exports", said Louis Turner, Associate Fellow, Asia Program, at leading international think tank Chatham House in London. "This offers an opportunity to produce a more balanced economy ... and a lot of the trade tensions will start to go away."

However, Martin Wolf, chief economics commentator at the Financial Times, said that the shift could be very difficult, because it may lead to disruption in investment and a rise in bad debts, which will undermine the financial sector. China's local government debt amounted to about 10 trillion yuan ($1.59 trillion), according to a National Audit Office report in mid-2011.

"The transition is going to take five to 10 years. They (policymakers) have to consider it as a long term process," Wolf said.

In the near term, growth prospects may be better than the target indicates, analysts said. Last year, the official target for growth was 8 percent, but actual growth reached 9.2 percent. "It could happen again this year, with real growth possibly being around 8 percent," Jia said.

If headwinds from the West were less than anticipated, China's real growth could be even higher this year, said a report by the Australia and New Zealand Banking Group Ltd. "Given the difficulty of adjusting short-term activity, large local government investment may see growth surprise the market on the upside, more so if there is a strong US economic recovery and a lessening of risk in Europe," it said. "We maintain our forecast of 9 percent GDP growth this year."

Wen highlighted the challenges in his opening speech.

"Global economic recovery is facing difficulties and reverses and the financial crisis is still evolving; the sovereign debt crisis, in some countries, will not be easing in the near future," he said. "The emerging economies are facing the dual challenge of rising inflation and slowing growth ... and protectionism is on the rise."

Although China's long-term growth prospects remain sound, it is facing a complicated domestic and international situation, said Zhang Ping, minister of the National Development and Reform Commission.

"It (the 7.5 percent target) is not an easy one to accomplish."

Zhang Xiaoji, researcher at the State Council's Development Research Center, agreed. "The growth situation is severe for China," he said. "It will take a great effort for China to avoid a hard-landing," he warned.

To avoid an economic slump, he suggested continued reform of the income distribution system to encourage consumption, a view shared by Wen.

Other systematic reforms detailed by Wen in his report focus on key sectors such as railways, power, finance, energy and education. Private investors will be given access to these areas to create a level playing field, he vowed.

"Regulations could be changed to enhance the scope for new entrants to compete with incumbent providers, at least in those lines of business where such competition is feasible," Hansson said.

Wen said in his report that the country will try to keep inflation at about 4 percent this year, unchanged from the 2011 goal.

Wen reiterated that a "proactive" fiscal policy and a "prudent" monetary policy will be maintained. The government in February lowered the reserve requirement for banks for the second time in three months to increase lending. It also raised interest rates five times from October 2010 to July 2011.

You may contact the writers at xinzhiming@chinadaily.com.cn and diaoying@chinadaily.com.cn.

Ding Qingfen, Wang Xiaotian, Lan Lan and Zhou Siyu contributed to this story.

Wu Ying, iPad, Jeremy Lin, Valentine's Day, Real Name, Whitney Houston, Syria,Iranian issue, Sanyan tourism, Giving birth in Hong Kong, Cadmium spill, housing policy

|

|

|

|

|

|