|

|

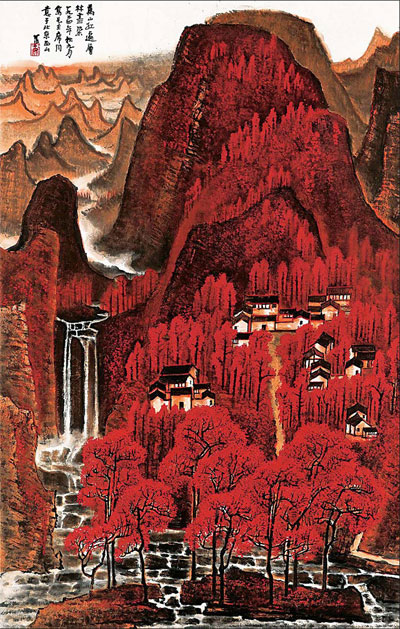

Wan Shan Hong Bian, by Li Keran. Provided to China Daily |

The artist has become a favorite at auction and his works are fetching record prices. But overall, the Chinese contemporary art market has cooled, Lin Qi reports in Beijing.

Li Keran (1907-89) took center stage at the spring sales with two historic works both crossing the 100 million yuan ($16 million) threshold.

His 1974 painting of former chairman Mao Zedong's residence in Shaoshan, the revolutionary holy land in Hunan province, fetched 124 million yuan at China Guardian, in May.

Three weeks later his large-scale blockbuster of 1964, Wan Shan Hong Bian (Thousands of Hills in a Crimsoned View), was sold for a personal record of 293 million yuan at Poly International Auction.

Li, a prominent figure in 20th-century Chinese art, is recognized for innovating the mountain-and-water painting genre after the founding of New China in 1949. He is also remembered for breathing new life into art education.

Figures from the Beijing-based Art Market Monitor of Artron (AMMA) show the price per 0.11 square meter of Li's works has increased 175 percent, rising from 1.35 million yuan after the autumn sales in 2011 to 3.72 million yuan at the end of June.

This great leap makes Li an exception, compared with other modern masters such as Qi Baishi (1864-1957), Zhang Daqian (1899-1983) and Xu Beihong (1895-1953), whose works haven't generated the staggering prices seen in the spring boom of 2011.

The phenomenon is seen as a continuation of the market slowing down since the autumn sales, influenced by the credit squeeze policy and macroeconomic control.

For instance, Zhang Daqian grossed an auction turnover of nearly $555 million in 2011, and replaced Pablo Picasso as top in the global artist ranking by auction revenue, according to the French art market information provider Artprice.com.

His Lotus and Mandarin Ducks sold for a personal best when it went under the hammer for $24 million at Sotheby's 2011 spring sales in Hong Kong.

Meanwhile, his best performance in spring at the "Big Four" auction houses - Christie's, Sotheby's, China Guardian and Poly International - was 29 million yuan ($4.62 million) for a re-creation of Song Dynasty (960-1279) artist Li Gonglin's painting.

"Most record-setting works by Qi Baishi and Zhang Daqian in previous auction seasons had formerly been owned by celebrated collectors or were the flagship creations of a certain period. Those paintings quickly sold out in a booming market," AMMA's director Guan Yu says.

The market, however, cooled in the latter half of 2011 and there was little confidence in spring 2012 because of an uncertain economic prospect. Guan says buyers have become more rational.

"Many elements are taken into consideration when deciding the value of an artwork, which include the artist's status, the hierarchy and how representative the work is, in addition to the art publications and catalogues it has appeared in."

Though a record was set by Wan Shan Hong Bian, two other important paintings by Li were unsold, which came as no surprise for art collectors like Yan An.

"Both big players and new buyers are bidding for the best works of the blue-chip artists, while the market can't provide as many top-notch artworks and provide the reduced risks that people expect.

"This is because in the face of an unclear market, cautious owners would rather keep those items, which achieved skyscraping prices, rather than flip them at auction," Yan says.

It has become a tug of war between owners and buyers, he adds.

There is some reassurance for art dealers, collectors and analysts, however, and that is the category of modern masters in the 20th century will continue to serve as a powerful engine, because of its immense stock and wide price ranges - and acknowledgement of its artistic value among buyers.

Traditional painting and calligraphy have been pillars of the Chinese art market. The category accounted for nearly 60 percent of China's art market share in 2011.

The prices of Chinese modern painting and calligraphy have kept surging up over the past five years, and reached a climax in the spring sales of 2012.

"Although the market fell in 2011's autumn sales, the price is still on a high level compared to other categories," Guan says.

AMMA's statistics show that by June 21, Chinese modern paintings took up five positions in the spring sales' top 10 artworks, in terms of auction price.

"We are optimistic that the market for Chinese modern paintings will continue to grow, while newer buyers will mature as they expand their collection and gain experience in the market," International Specialist Head of Christie's Chinese Paintings Department Ben Kong says.

He stresses that it is important to have a normalized and healthy market for Chinese paintings.

Guan says although several modern masters have ascended to the 100 million yuan club, fueled by huge influxes of capital in previous auction seasons, records are difficult to break. The market tends to seek breakthroughs in terms of works by more artists of different genres.

Kong says investment should possibly be secondary when looking at a painting, because "there is always a certain degree of risk in any investment activity".

"The primary focus for collecting is still the love and appreciation that one experiences or gradually learns," he says.

Contact the writer at linqi@chinadaily.com.cn.