The multi-purpose vehicle segment travels a long distance in China, bringing cheer to carmakers

After strolling around the Auto China 2016 expo held from April 25 to May 4 in Beijing, and checking out 1,000 cars displayed by more than 100 automakers from around the world, this is what Luo Xin, a 36-year-old Beijing bachelor, had to say: "MPV is perfect for family."

Luo already owns three cars. He is looking to marry soon, and then father one or two kids. The New Multivan, Volkswagen's multi-purpose vehicle, is one of his favorites, he said. "All my male friends, who are married with children, want to buy an MPV."

|

A woman checks a new model's mirror during a recent auto fair in Yichang, Hubei province. The MPV segment has been growing rapidly in the past three years. Liu Jiao / For China Daily |

|

With the second-child policy now in place, many couples are expected to have two children, which, in turn, could make the MPV segment the sweet spot in the auto market. Li Wenming / For China Daily |

|

Workers monitor an MPV production line at a passenger vehicle manufacturer in Anhui province. Hu Weiguo / For China Daily |

Luo said the price of the New Multivan is similar to that of the Mercedes V-Class. But the car's interior could have been better, he said. So, once he has a family, he would choose Toyota's Sienna as it is "more cost-effective and very safe".

Luo owns an English training institute. He uses his Buick GL8 for picking up students and their parents. The Mercedes-Benz E320L 4MATIC is for meeting clients. And the Porsche Boxster is for fun.

He symbolizes the change sweeping the passenger car market in China. Chinese consumers no longer view vehicles as a means to show off but as machines that serve practical purposes.

With the second-child policy now in place, young couples are expected to have two children, which, in turn, could make the MPV segment the sweet spot in China's auto market, the largest in the world.

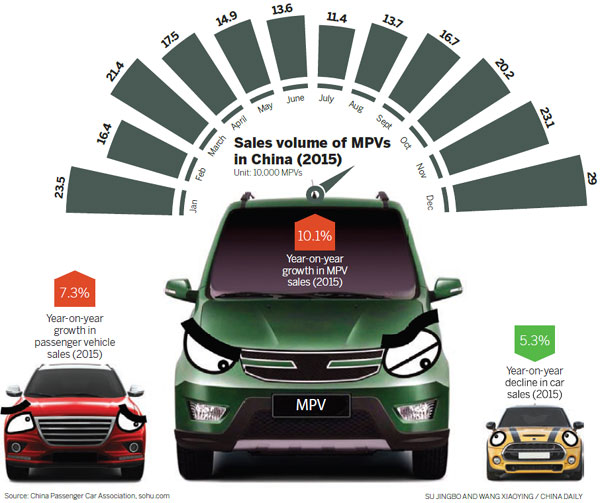

The MPV segment has been growing rapidly in the past three years. Sales touched about 1 million units in 2013. That was almost 7 percent of the total passenger vehicle market, just 4.67 percent less than small cars.

In two years, that is, in 2015, MPV sales soared to 2.2 million units, up 14.2 percent over 2014, accounting for 10.49 percent of the overall passenger vehicle market, and becoming the fourth largest segment, just shy of the third place.

Industry insiders predict that by the end of this year, MPVs would overtake mid-size cars to become the third best-selling auto segment in China, just behind compact cars and sports utility vehicles. So, automakers are optimistic about MPVs' future in China.

"We see great potential for high-end MPVs like the V-Class," said Guido Krupinski, CEO of Fujian Benz Automotive Co, a three-way joint venture of Daimler Vans Hong Kong Ltd, BAIC Motor Corp and Fujian Motor Industry Group Co.

"With the economy as well as individual incomes growing, domestic elites will have more diversified and individual demands for trips. So, the market for high-end MPVs that can satisfy both the family and business demands will continue to grow."

Krupinski said the second-child policy, in particular, will have an impact on the population structure, family structure and economic development in the decades to come. He believes that a bigger family size will create a need for bigger cars.

Hiroji Onishi, head of Toyota Motor's China operations, told Reuters that "MPVs have good prospects in China. Given the changing life-stage needs, we think what's going to be popular are smaller, more affordable MPVs like the (Toyota) Noah Voxy, a compact minivan which we market in Japan".

He said young Chinese couples tend to live near their parents, so the second-child policy is expected to make family units larger.

According to Reuters, Toyota officials and dealers think the Voxy's interior comfort offers a more subtle way for China's rich to signal their wealth in a climate where overt excess is frowned upon. And in China, trends that catch on at the premium end traditionally spread quickly through the rest of the market.

China's MPV segment is divided into several niche markets. The low-end models with pricing range below 100,000 yuan ($15,350) currently account for the majority of sales.

For example, the top two best-selling models last year were the Wuling Hongguang microvan and the Baojun 730 minivan, both produced by SAIC-GM-Wuling, a joint venture of General Motors, SAIC Motor Corp and Guangxi Automobile.

The popular models with a pricing of about 200,000-400,000 yuan are the Buick GL8 and the Honda Motor Co's Odyssey.

For the lucrative high-end niche, the typical model is the Mercedes-Benz V-Class, a replacement of its former Viano, with a price range from 500,000 yuan to 600,000 yuan.

Zeng Zhiling, managing director of LMC Automotive Consulting (Shanghai), said the most important reason behind the rise in MPV sales is the China Association of Automobile Manufacturers' rejig of vehicle categories in 2013, classifying minivans as MPVs.

Zeng said the rising demand for logistics and commuting in the lower tier cities and towns, as well as the expected rise in use of MPVs by high-end families in the wake of the second-child policy, are also key reasons.

"But the market for the high-end MPV is small, about tens of thousands of units every year," Zeng said. He predicts the growth rate of the segment would slow down in future, and sales would still be contributed mainly by low-end MPVs.

Zhang Yu, managing director of Automotive Foresight Co, said the segment will retain a growth rate of more than 10 percent year-on-year for the next five to six years. But the segment structure would be the same, with low-end models accounting for the majority of the sales.

"Many people say an MPV is the next breakthrough point, I am not sure about that," said Zhang, adding that MPVs lack good models that can compete with SUVs in off-road functions and in terms of reflecting the car owner's taste and social status, which is vital in China.

Zeng said most customers of MPVs are from semi-urban areas, whose budgets are between 50,000 yuan and 70,000 yuan. "The customers decide the products, not the producer," he said.

duxiaoying1@chinadaily.com.cn

|

A senior couple inspects a new energy vehicle during a recent auto fair in Nanjing, Jiangsu province. Su Yang / For China Daily |

|

Customers inspect a Ford S-MAX at a recent auto promotion in Chongqing. MPV sales have risen of late, making them a hot segment in the Chinese auto market. Zhong Guilin / For China Daily |

(China Daily USA 05/23/2016 page13)