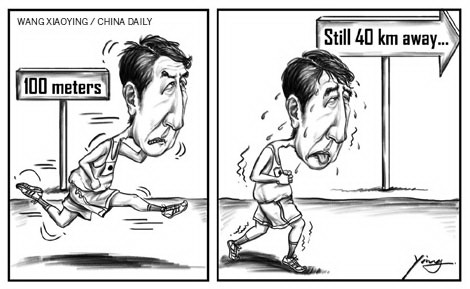

'Abenomics' may not cure Japan

The Japanese economy has not recovered from its persistent deflation problem and the shocks it has suffered in the past years. After being the world's second largest economy for 42 years, it slipped to third in 2010, yielding the place to China. Even politically, Japan cannot be said to be stable. It has had five prime ministers between September 2007 when Shinzo Abe resigned as prime minister and December 2012 when he assumed office for the second time.

Abe may have returned to power with a landslide victory of the Liberal Democratic Party in the general election, but he has to take aggressive measures to end deflation and revive the economy to be seen as a successful prime minister.

Shortly after taking office, he introduced what many refer to as "Abenomics", a series of ambitious plans to end deflation which include aggressive monetary easing, setting a new 2 percent inflation target and a proactive fiscal policy with a generous spending of about $1.14 trillion in 15 months. Also, he has promised to unveil the details of his economic growth strategy in June.

Japan's long-term deflation is the result of stagnation of private consumption, which can be attributed to little or no increase in people's salaries. During deflation, companies neither increase their investments nor recruit new employees, let alone increasing wages. They prefer to put their money in banks to avoid risks.

To shake off deflation, the Abe government should take measures to boost private consumption which, in turn, will bolster GDP growth. Abe recently met with senior managers from major economic sectors, as well as CEOs of some large enterprises, and urged them to raise workers' pay. He even said companies that increased employees' salaries would get incentives, including some corporate tax exemptions.

Still many enterprises find it difficult to raise salaries because a depreciated yen can only theoretically add to their revenues but contribute little to their real growth. Some major companies, such as Sony and Panasonic, have been incurring losses for several years now and were even forced to sell their office buildings in places like Japan and the United States.

Thus "Abenomics" has little possibility of leading Japan out of deflation and toward real recovery in the short term. The Tokyo Stock Exchange seemed to hold out some hope in February. But it was the persistent policy of devaluing the yen that forced share prices to rise sharply and the Nikkei to reach 11,463 points on Feb 6, an increase of 32 percent from 8,667 points at the end of November 2012 and the highest since the 2008 finical crisis.