Slower growth consistent with post-industrial era

By Dan Steinbock (chinadaily.com.cn) Updated: 2016-02-18 14:18The contemporary Chinese economy is a dual story about the demise of industrialization and the rise of the post-industrial society. As innovation and consumption already fuels the first-tier mega cities, investment-fueled expansion is still needed for rapid growth in lower-tiered cities.

Furthermore, Chinese deceleration must also be seen in the context of the international environment, which is characterized by diminished growth prospects.

Stagnation in the West

When Deng Xiaoping launched economic reforms and opening-up policies in China, he relied on the advanced economies' ability to invest in foreign markets and absorb cheap exports. For three decades, this international environment fueled China's investment and export-led expansion, supporting double-digit growth through industrialization.

World trade and investment accelerated. International demand soared. Oil and commodity prices climbed sky high.

After the global crisis of 2009-9 and subsequent recovery policies and stimulus packages, that old normal is history. World trade has plunged. Demand has weakened. Oil and commodities have collapsed. In the advanced West, growth is now possible only on the back of record-low interest rates or steady injections of quantitative easing, or both.

In the emerging economies, the crisis years translated to "hot money" (short-term portfolio) inflows, which contributed to asset bubbles, imported inflation and currency appreciation. In China, the combination of domestic stimulus and foreign hot money inflows led to overheated property markets, huge local debts and overcapacity.

In China, the government's growth target of 6.5 percent for 2016 is ambitious but feasible. Assuming there will be a peaceful international environment and gradual domestic reforms, it is likely to further decelerate to about 5 percent by 2020.

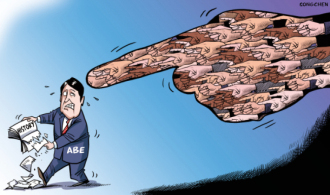

Internationally, that should be seen as a success. In the next decade, US annual growth is unlikely to exceed 2.5 percent (if a debt crisis is avoided), eurozone expansion will remain less than 1.5 percent (if the region doesn't disintegrate) and Japanese growth will struggle at 0.8-1 percent (as debt climbs to 300 percent of GDP). At the same time, the Chinese economy has the potential to grow 2-3 times faster than major advanced economies, if market-oriented structural reforms can prevail.

As the old China of manufacturing, investment and exports is fading, the new China of services, innovation and consumption is emerging.

The author is the founder of Difference Group and has served as research director at the India, China and America Institute (US) and visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Centre (Singapore). For more, see www.differencegroup.net

This article first appeared in Global Times on Jan 27, 2016.

The opinions expressed here are those of the writer and don't represent views of China Daily website.