Strong trade data, partly due to holiday effect

|

|

Exports and imports.[Photo provided to chinadaily.com.cn] |

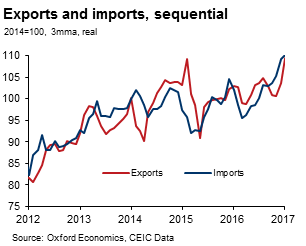

As expected, headline trade data was strong in January. Exports posted their first increase in US$ terms since March last year, boosted by the timing of the Chinese New Year. Import momentum remained solid, following the impressive sequential run up last year, indicating continued steady domestic demand momentum and higher commodity prices. That said, we remain cautious on the outlook for both global demand and Chinese domestic demand later in the year.

• Headline goods exports rose a healthy 7.9 percent year-on-year in US$ terms in January, the first month of headline year-on-year growth since March 2016. The caveat is that trade is bumpy in the first months of the year, especially exports, due to the varying timing of the Chinese New Year (CNY) holiday. With most of the CNY holiday falling in February this year, exporters are likely to have pushed out shipments in January before closing for the holiday. Based on our estimates of price developments, goods export volumes were up 12.2 percent year-to-year last month from a relatively weak base while the 3mma seasonally adjusted monthly export volume accelerated impressively, pointing to improved momentum going into 2017. Nonetheless, with the climate for China’s exports to the United States undeniably getting harsher this year under the Trump administration and risks of more broad damage to global trade, we remain cautious on the export outlook later in the year.

• Goods imports posted a 16.7 percent year-on-year increase in US$ terms in January. With import prices in US$ terms having picked up significantly in recent months due to the rise in commodity prices, we estimate that goods import volumes rose a hefty 13.7 percent year-on-year. That was to be expected, given the strong run up in the sequential data throughout 2016 (see Chart). Nonetheless, the sequential 3mma month-on-month momentum remained healthy in January. Indeed, given this recent history and the recovery in commodity prices, headline import data is bound to remain solid in the coming months. The strong import data points to robust domestic demand in China at the beginning of 2017. However, the ongoing housing market correction and lower credit growth are likely to weigh on import growth in the year ahead.

The author is the Hong Kong-based head of Asia economics for Oxford Economics.