Sorrell: Nation's firms ready to go global

Updated: 2013-06-08 10:36

|

|||||||||||

|

|

The Chengdu High-Tech Development Zone is a major driver for the city to go global, as its local companies are promoting their brand names to overseas while a lot of international big names have set up operations there. Provided to China Daily |

Intl expansion to create more business for WPP

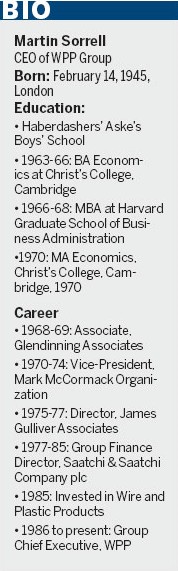

Martin Sorrell, CEO of the world's largest advertising company WPP Group, sees great potential for his company to grow further in Chengdu because he believes many Chinese companies in the city have the potential to expand internationally.

Sorrell, 68, is a respected figure in the global advertising industry and a speaker at this year's Fortune Global Forum in Chengdu which opens today. He says he will be staying in Chengdu for two weeks to meet potential clients.

"I'm using the conference in Chengdu as a hook to meet Chinese companies that we think not only have opportunities to brand and develop their market in China but also abroad," Sorrell says.

Sorrell said that the city is important to China's growth because it helps the western region catch up with the rapid development in coastal cities like Beijing and Shanghai.

As the host of this year's Fortune Global Forum, Chengdu will show the world a fuller picture of what China offers, he said.

"When people think about the US, they think about New York and Washington DC. But it's not. It is also Detroit, Chicago, Dallas and the West Coast. Likewise, I do think you have to think about China in a much broader way," Sorrell said.

Sorrell is regarded as a pioneer in the advertising industry and a major driving force behind the consolidation of the global communications industry in the past two decades.

In 1985, Sorrell privately invested in Wire and Plastic Products, a British wire shopping basket manufacturer, and joined it full time as chief executive in 1986.

He then started a series of acquisitions for under-priced advertising-related companies, a strategy that eventually made WPP the world's largest advertising company by revenue.

China operations

Fully convinced of the nation's growth potential, Sorrell played a key role in WPP's expansion in China. In 2012, the country became WPP's third-largest market after the US and UK, with a revenue of $1.3 billion.

Several companies under the WPP network were among the first marketing and public relations companies to open offices in China, including Ogilvy & Mather in 1981, Hill & Knowlton in 1984 and Young & Rubicam in 1985.

WPP companies have also won many high-profile contracts and clients in China, including the organizing committees of the Beijing Olympic Games and Shanghai World Expo, and some of the largest Chinese companies, such as China Mobile, ZTE, Suning Appliances and Lenovo.

A number of WPP Group companies already have operations in Chengdu, including Burson-Marsteller, Ogilvy & Mather, GroupM and Hill & Knowlton.

In the wake of the tragic Wenchuan earthquake in 2008, Ogilvy & Mather worked with the Chengdu government to help rebuild the province's reputation and image as a business and tourist destination.

Ogilvy was the developer of the Panda Ambassador campaign worldwide, which was intended to raise Chengdu's global profile. The campaign's strategies included painting pandas on taxis and organizing exhibitions of panda-themed paintings in big cities internationally.

As a part of WPP's corporate social responsibility work, it funded the reconstruction of a primary school in Guangyuan city near Chengdu that was devastated during the earthquake. The donations helped fund new school buildings capable of accommodating 150 pupils as well as a dormitory for 45 students and four teachers and a new playground.

From his interactions with Chinese clients, Sorrell has observed that Chinese companies are increasingly recognizing the need to develop branding.

"Traditionally, they have focused on developing a good product, which has a lot of (brand) awareness and is at the right price points for Chinese consumers, but had no price premium," Sorrell said.

Awareness to loyalty

Sorrell said that awareness is different from loyalty. He said that many Chinese companies have built awareness through good distribution channels, but only loyalty generates a price premium.

By comparison, foreign brands have done a better job at cultivating brand loyalty in China, but they lose to Chinese brands on market penetration partly because they are too expensive for Chinese consumers from lower-tier cities.

To explain the benefits of branding, Sorrell cites BrandZ Top 50 most valuable Chinese brands, a report WPP has produced annually since 2010.

Calculations are made by stripping away financial components from corporate earnings to derive the company's brand value.

According to the 2013 report, the top 50 Chinese brands grew by 5.8 percent in stock market value in the 14 months ending in September 2012, whereas the Morgan Stanley Capital International China Index, a weighted index of Chinese stocks, declined by 5.6 percent.

A more stark demonstration of this trend is shown by the performance of BrandZ top 10 most valuable Chinese brands, which rose by 29.2 percent in value over the same period.

"BrandZ shows demonstrably those companies that have invested in their brands are good investments. As China's 12th Five-Year Plan (2011-15) kicks in, social security will become a safety net as people don't have to worry about their health anymore, so service will be more important (in differentiating brands)," Sorrell says.

The 2013 BrandZ report said that key factors contributing to the development of brand value in China include response to consumer demand, innovation, investment in brand building campaigns, strategic plans to repair reputations damaged by safety issues, and forming alliances with reputable international brands.

The report gave high rankings to many Chinese technology companies and financial services companies, including China Mobile, Industrial and Commercial Bank of China, China Construction Bank, Baidu and Tencent.

Sorrell said that Chinese brands are also starting to focus on adapting to consumer requirements when they compete on the international stage. This is an aspect that local enterprises may have neglected because the nation's large population of consumers provides them with a constant source of ready buyers.

"The problem with Chinese companies is that they are blessed with a market of 1.3 billion people - the American market only has 300 million," Sorrell said, explaining that such an advantage can act as a disincentive for some Chinese companies to internationalize.

"So I remember the chairman of China Mobile saying to me when they bought Paktel in Pakistan that Paktel only has 10 million customers, whereas China Mobile adds five million customers every month," Sorrell said.

"It prompts you to question, 'Why bother with Paktel, when in two months, you can add the same number of consumers?'"

International growth

While Chinese companies may only have good reason to expand globally after the domestic market becomes saturated, they must prepare early for international growth, Sorrell said.

"(Focusing only on the domestic market) would be a strategy that would run out of road quickly. We're seeing massive investments from Chinese companies in Latin America, Europe and Africa. Chinese companies are increasingly aware of the international opportunities," he said.

He says one good example is the Chinese white goods company Haier, which won many contracts for its air conditioners in America's student accommodation market.

"They had to manufacture highly effective units, but they had out-competed Japanese manufacturers. It is a considerable achievement for Haier because Japanese companies like Sony and Mitsubishi dominated many export categories before China's industrial revolution started," Sorrell said.

He says that another good example is Lenovo, which started thinking more internationally about customers' needs after buying IBM's PC division in 2005, adding that he believes many more Chinese brands will follow this path.

"The simple truth is that China has been a manufacturing hotbed for decades because of cheap labor. Costs are starting to rise, and Chinese manufacturers now must think differently about what consumers want and be more innovative," Sorrell said.

Sorrell said that Chinese companies will rapidly catch up with Western companies on innovation, although he does not like the idea of implying that the West is ahead.

"China's process will be much more rapid. China has not gone through a PC revolution. China has gone through mobile and smart phones, whereas we went through tablets and then smart phones and smaller screens," he says.

Sorrell said that China's digital revolution, with new platforms like Sina Weibo and Tencent Weixin, has also provided Chinese companies great opportunities to build brands.

"Television and the press will not be as personalized as online media, whether it be search or display or video or mobile," he said.

"The West believes they have some sort of superiority from an innovation point of view. They might at the moment, but it will be challenged as China develops more in the future," Sorrell said.

He said that China will shift from a manufacturing hub to an innovation economy more rapidly than other Asian economies, such as Japan and South Korea, which made this transition not long ago.

"I think the Chinese are different (from Japanese and South Korean companies). They listen very effectively and learn very effectively. Coming from a big trading nation, they are very flexible and react more quickly to changes," Sorrell says.

Chengdu is already in a leading position on the journey to more sustainable and innovative growth, as IT is one of the most privileged industries in the capital of Sichuan province.

Sustainability, innovation and technology are key themes of the Fortune Global Forum from Thursday to Saturday.

"Once Chinese brands get a basic understanding of branding and marketing - which I think they are on their way to doing - they will be extremely powerful. You will see the equivalent of Samsung, Sony and Toyota from China," he says.

cecily.liu@chinadaily.com.cn

- Chinese, US presidents start talks in Calif.

- Suspect in fatal bus fire identified

- Liu Zhijun to stand trial on Sunday

- 4 killed in California shooting spree

- Xi, Obama meet for

first summit - Stakes high ahead of

Xi-Obama summit - Xi's Latin American tour yields fruitful results

- Gaokao allowed away from home

Hot Topics

CPC National Congress,Mo Yan, Bogu Kailai, Diaoyu Islands, iPhone, Yao Ming, Sun Yang, Li Na, Liu Xiang, shenzhou, taiwan, hiv, school bus, house, hk, rare earth, food safety

Editor's Picks

|

|

|

|

|

|