|

Technicians inspect excavators at the Guangxi Liugong Machinery Co Ltd assembly plant in Liuzhou, Guangxi Zhuang autonomous region. [Photo/Xinhua] |

Region becomes strategic bridgehead for a growing number of ambitious Chinese investors keen to explore the broader European market, reports Ding Qingfen from Amsterdam.

As countries in western Europe continue to struggle against a tide of debt and stalled economic growth, countries in the east of the continent have been receiving record amounts of Chinese investment over the past year.

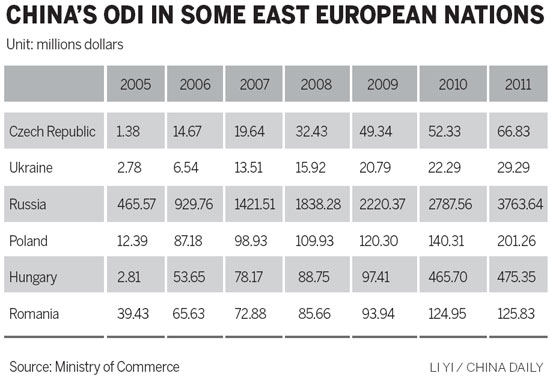

The growing interest in East Europe is clear when we look at the explosive growth of capital flowing into Russia last year.

According to the latest figures from the Ministry of Commerce, China's outbound direct investment into Russia in 2012 surged by as much as 120 percent from 2011, four times larger than the country's overall growth rate of 29 percent, for overseas direct investment during the period.

During that time, western European nations - a strong investment market for China for the past two decades - have either been reducing investment or pulling capital out of East Europe.

And experts said that has left the region as an ideal bridgehead for Chinese companies, to either invest there, or use it as a base to distribute their goods to the broader EU nations.

"There has never been a better time (to invest in East Europe) than now, and we expect the next decade to be a golden period for Chinese companies to invest in eastern Europe, especially with the west having little or no spare cash, as they take care of their own economies" said Yao Ling, a research expert at the Chinese Academy of International Trade and Economic Cooperation, a think tank affiliated with the Ministry of Commerce.

"Chinese companies have been investing in sectors where they hold an advantage, including textiles, light industry, machinery, infrastructure and telecoms," she added, explaining that eastern Europe is attractive to Chinese investors on various fronts.

"First, it provides them with a shortcut into the whole Europe. Also, the region has a competitive edge in terms of technology for China to learn from; it's a huge market and labor cost there is relatively low compared to other western markets," she said.

The latest high-profile move by a Chinese company into the region came in December, when Shanghai's electric-vehicle maker BYD Co Ltd signed a 50/50 joint venture with a Bulgarian partner to build an electric car and bus assembly plant in the country.

Located in a town west of the capital Sofia, the plant is expected to produce 40 to 60 buses per month, the first of which should roll off the production line this month.

BYD also expects the Bulgarian facility to make its entire product line of batteries and LED lights in the future.

"We already have sales in western Europe, but very few. The east of Europe is strategically important for BYD and as a market in itself," said Chen Yongping, its senior manager, Europe Region.

In January 2012, BYD beat two major competitors from the United Kingdom and the Netherlands to win an order for six electric buses from the Dutch government, its first overseas electric bus order.

Then in October, it secured another order of 50 electric cars from London cab service provider Green Tomato Cars.