Stress-busters in demand as life gets hectic

By Zhu Wenqian | China Daily | Updated: 2019-03-25 13:31

Sales of anti-hair loss products, sleeping pills and aids show market revival

Chinese born in the 1990s, long troubled by hectic lifestyles marked by working till late, heavy workload and career-related pressures, have a new problem to deal with: hair loss.

But certain manufacturers are sensing a big business opportunity as products that promise to cure or prevent hair loss are seeing something of a revival.

Last year, among consumers who bought hair care and hair growth products on e-commerce platforms of Alibaba Group Holding Ltd, 36 percent were born after 1990, and more than 38 percent were born between 1980 and 1990.

Middle-aged and senior consumers showed lower-than-expected demand for hair care products, according to a report by AliHealth, the health and medicine unit of Alibaba Group.

"With steady income growth of young Chinese, more people are paying attention to the quality of products, and they are willing to spend money on products that can help improve appearances," said Neil Wang, president of consultancy Frost& Sullivan in China.

"Fueled by the promotions featuring film stars and internet celebrities online, young consumers are increasingly seeking ways to appear more beautiful. Losing hair is something they can't stand. Expenditure toward better looks reflects the ongoing consumption upgrade trend in China," he said.

Besides, on social media platforms such as Weibo and Little Red Book, a Chinese online platform to share lifestyle tips, a large number of internet celebrities and makeup bloggers recommend or discuss products (like hair line powder and post-natal hair recovery oil) they think are good or useful.

"Internet celebrities and some KOLs (key opinion leaders) share user experiences and give good ratings for some niche products, so consumers get to know them, and young consumers tend to consider such recommendations. But product quality and personal preferences ultimately influence consumer decision whether or not to buy a product," Wang said.

The Alibaba report stated that among people who searched online using the keywords "hair loss", nearly 80 percent were male consumers. The largest number of buyers of hair care products came from Guangdong, Zhejiang, and Jiangsu provinces.

Online searches for hair care and hair growth products fluctuate through the year. In March, they tend to rise a bit; in August, they tend to surge, and peak in November, the report found.

Last year, sales of anti-hair loss products on Tmall, Alibaba's e-commerce platform for established brands, soared 100 percent, according to Tmall.

For instance, Hairmax, a hightech comb that boosts hair growth through use of laser beams, was launched last year. It proved to be one of the best-selling items during the Singles Day shopping festival on Nov 11. An anti-hair loss shampoo made in France, priced 888 yuan ($132.50), sold out fast.

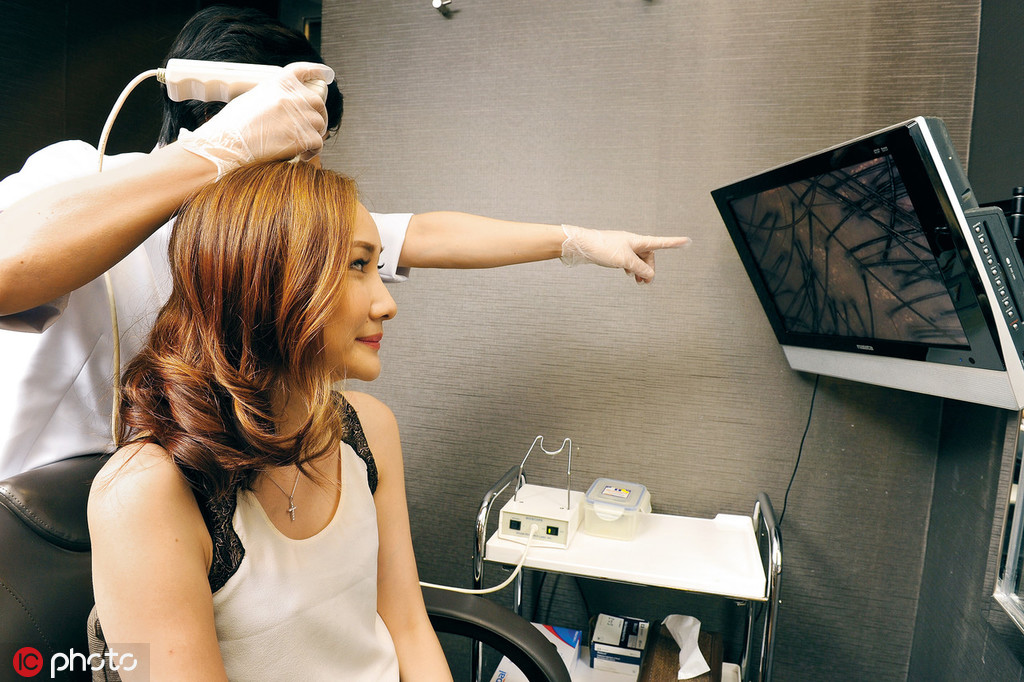

In addition, sales and marketing efforts of hair transplant specialists have deepened concerns of consumers troubled by hair loss. From 2016 to 2017, firms specializing in hair transplants saw an average annual sales growth of over 100 percent.

Beijing-based Yonghe Hair Transplant has 33 outlets nationwide. Its advertisements mark broadcasts of popular TV series in China, and adorn walls of several subway stations.

"With the development of hair transplant and hair care technologies, and amid growing anxiety of consumers suffering hair loss, strategic marketing is helping hair transplant agencies to post continuous growth," Wang said.

Stress-inducing lifestyles are creating demand for other kinds of products as well. A large number of young Chinese consumers reportedly suffer from insomnia. About 75 percent of those born after 1990 have a habit of staying up late. Inadequate sleep makes them use medicine like sleeping pills, like in the United States.

There, the incidence rate of insomnia is around 32 percent to 50 percent, and the sleeping economy has created businesses worth tens of billions of dollars.

In China, the incidence rate of insomnia is around 38 percent, and the market size of sleeping pills and sleep aids has exceeded 250 billion yuan, according to Frost & Sullivan data.

In the next few years, demand will grow, and the market for sleeping aids and medicine will likely emerge as an important sub-category of the sector that makes sleep-related products. The sub-category is foreseen to continue to expand, Frost & Sullivan data showed.