A new global report into levels of personal wealth has predicted the number of millionaires in China will double, and the country will overtake Japan as the world's second-wealthiest nation, in the next five years.

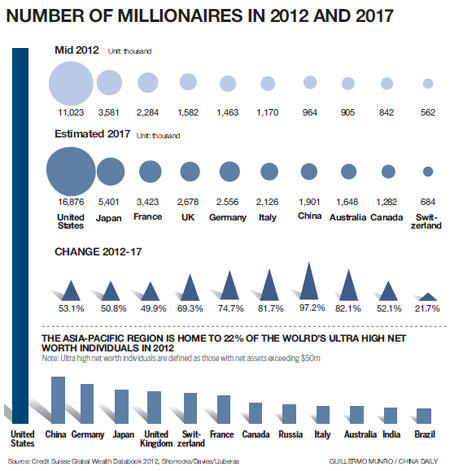

According to the Global Wealth Report 2012, carried out by the Credit Suisse Research Institute, there were 964,000 millionaires in China by mid-2012, and the number is expected to almost double to 1.9 million by 2017, driven by the rapid development of the country's private sector, the report said.

The study defined household wealth as the value of financial assets and non-financial assets minus total household debts.

All household wealth was valued in current US dollar terms.

The third wealth report to be produced by the organization showed China's total household wealth jumped $562 billion, or 2.9 percent, to $20 trillion by mid-2012.

Credit Suisse said it expects China to add another $18 trillion in family wealth in the next five years, with its projected $38 trillion total surpassing Japan's $35 trillion, making it the second wealthiest country by 2017.

By then, the United States is forecast to be the world's richest nation, with an $89 trillion of household net worth.

The report said that China has been the most important source of new wealth creation in the Asia-Pacific region over the past decade, with household wealth growing at an average of 13 percent per annum since 2000, more than double the average global wealth growth rate of 5.8 percent.

"Due to a high savings rate and relatively well-developed financial institutions, a high proportion of Chinese household assets are in financial form compared with other major developing countries," it said.

"At the same time, privatized housing, new construction and rural land are very important forms of wealth in China," the report added.

"However, wealth inequality has been rising strongly with the wealth of successful entrepreneurs, professionals and investors increasing."

Presenting the results in Hong Kong, Fan Cheuk-wan, Credit Suisse's managing director and head of research in Asia-Pacific, said: "China's household wealth has risen due to the urbanization process, and the boom of the private sector."

He added that he expected the 18th National Congress of the Communist Party of China, to be held in early November, to provide a platform for the country to enter the next phase of economic restructuring, which may contribute to more wealth creation in future.

The report revealed that aggregate global household wealth fell $12.3 trillion or 5.2 percent to $223 trillion in 2012, representing the first annual decline since the 2008-09 global financial crisis.

"Economic recession in many countries combined with widespread equity price reductions and subdued housing markets have produced the worst environment for wealth creation since the global financial crisis," Fan said.

"However, as the global economic recovery will be sustained in the future, we do not expect a wealth destruction process to happen as it did during the 2008-09 financial crisis."

oswald@chinadailyhk.com

Use of RMB as settlement currency rise

Use of RMB as settlement currency rise Daimler starts new $2.4b plant

Daimler starts new $2.4b plant Overdue loans pile pressure on lenders

Overdue loans pile pressure on lenders