China's housing prices will not rise sharply this year and the property market will develop stably, economist Ren Xingzhou said at the 2013 Chinese Economy Analysis and Prediction Conference held in Beijing Sunday.

National Bureau of Statistics data show that December 2012 saw 54 of a statistical pool of 70 major Chinese cities, up from 53 in November, record higher new home prices than a month earlier. This marked a third consecutive month of increases.

However, Ren, director of market economy research at the Development Research Center of the State Council, a leading think tank, said the surge will not last long as there are not enough conditions to support a large-level rebound. Ren analyzed the property market last year before giving a prediction for this year at the conference, which was held by the China Economy Yearbook and Guozhi Media Corporation under the guidance of the think tank.

Ren said housing prices were relatively low in January and February last year and began to rise gradually and then rose dramatically at the end of the year, especially in November.

She explained that the fine-tuning of macro economy policy toward pro-growth, especially financial policy, may have directly or indirectly affected the property industry. She added that a 10 to 15 percent discount on interest rates for first homes was available last year.

Ren said her research team found that a one percentage point drop in interest rate will raise a household's purchasing power for the same apartment of the same area at the same place by six percent.

Related Readings

China's property investment up 16.2% in 2012

China's property tax trial expansion in doubt

Property developers' sales see solid growth in 2012

Beijing's Dec property sales to reach record high in 2012

Property curbs to stay in place for 2013

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

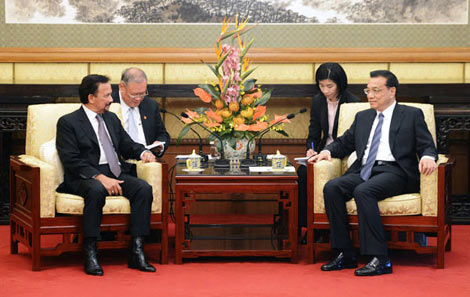

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show