China's major property developers' profits are falling due to rising operational, labor and raw material costs, according to an industry study.

Despite fast-growing property sales last year, average net profits of the country's top 500 developers stood at 434 million yuan ($68.9 million) in 2012, down 18.64 percent year-on-year, according to the study conducted by the China Real Estate Research Institute, China Real Estate Association and China Real Estate Valuation Center.

The average return on assets for the top 500 developers was 2.15 percent for 2012, compared with 33.31 percent for 2011. Their average rate of return on common stockholders' equity was down 39.88 percent year-on-year to 4.7 percent.

China Merchants Property to double sales target this year

Greenland Group to tap Australian property market

Longfor's 2012 net profit up 19%

Housing still on unsustainable path

Real estate recovery gathering steam

Vanke's net profits surge 30.4% in 2012

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

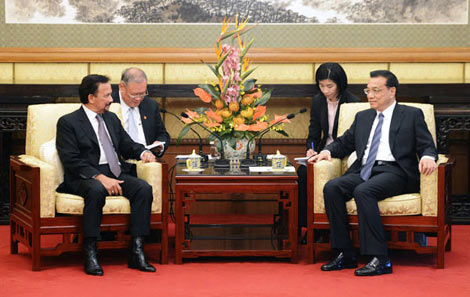

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show