NANJING -- Chinese shipbuilders have been sailing toward bankruptcy in recent years, with China trying to consolidate the industry and bail it out from the woe of overcapacity.

With delays in deliveries, order cancellations and price decreases for newly-built vessels, shipbuilding firms have been in a slump since late 2008, when the global financial system was in free fall.

Cash-strapped shipping companies froze expansion plans by scrapping or delaying orders. The euro crisis from late 2009 made the situation even worse.

Statistics from China Association of National Shipbuilding Industry showed in the first half of 2013, 80 major enterprises made a combined business revenue of 120.3 billion yuan ($19.6 billion), down 18.5 percent year on year. Total profit dropped 53.6 percent to 3.58 billion yuan.

In terms of production, it is estimated there will be a fall of around 50 percent in 2013, according to a Ministry of Finance report in August.

"The color of the industry was gray in 2011. It was black last year. For this year, it's red, bloody red," said Chen Qiang, president of Rongsheng Heavy Industries Group Co, China's largest private shipbuilder. Operating revenue for 2012 at the company stood at 7.9 billion yuan, down 50 percent year on year.

China's shipbuilding industry was in a "golden age" in 2004, when shipyards, especially those with private investment like Rongsheng, mushroomed as a symbol of the country's booming economy.

Before 2000, the number of shipyards in China were in the hundreds. The industry quickly ballooned to more than 3,000 by 2007 under a "get-rich-quick" mindset. China entered the world's top three in terms of shipbuilding, together with Japan and the Republic of Korea (ROK).

Now, the industry is a shadow of its former self.

Though bankruptcies remain rare despite mounting losses even at well-connected state-owned firms, many are teetering on the brink.

In eastern China's Jiangsu Province, the country's largest ship builder, companies have been warned that if there are no new orders, the backlog will merely be enough to "feed" enterprises for another two years.

According to the provincial commission of economy and information technology, ship completion and current orders in Jiangsu dropped by 32.9 percent and 17.5 percent year on year respectively in the first half of 2013. Among 66 shipbuilding enterprises, only 23 received new orders.

Even those with orders are not positive.

"Profit margins are already razor thin as prices are being pushed down," said Tang Yong, chief financial officer of Dayang Shipbuilding Co., Ltd. in Yangzhou.

The price for a new ship is the lowest in a decade, said Tang.

Many firms are not willing to go out of business, as China lacks a bankruptcy mechanism to allow creditors to be compensated. Many believe the one that sticks it out stays alive.

"The industry itself is a ship so bloated that a slimming plan is in dire need to shift it in the right direction," said Song Songxing, a business management professor with Jiangsu-based Nanjing University.

"If not, low-end products will continue snowballing until it drags down the whole industry," said Song.

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

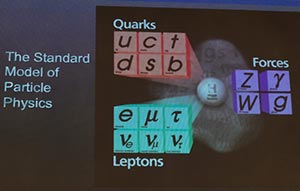

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists

Tibet expected to witness bumper harvest

Tibet expected to witness bumper harvest

Shanghai inaugurates Free Trade Zone

Shanghai inaugurates Free Trade Zone