Li Yanqing, director of China Shipbuilding Information Center, said low value-added products like bulk carriers, oil tankers and container ships, dominated shipyards. Li said Chinese shipbuilders were far behind Japan and the ROK in production management, work efficiency and developing high value-added products for ocean engineering projects.

"Chinese ship builders are competing fiercely with each other on the easy-to-make-but-cheap products, while few are willing to invest in the development of high-end products, which is no good for the long-term health of the industry," said Li.

Signpost on the sea

The central government has also identified the need for deeper structural reform to remedy the inefficient and debt-laden industry.

The State Council, or China's cabinet, issued a three-year plan to consolidate the industry in August, which includes measures to halt approvals for new shipbuilding projects and freeze credit support for expansion of facilities.

Meanwhile, the cabinet has vowed to prioritize the development of ocean engineering products, for example deepwater drill ships and rigs, which there is a rising global need for as the world seeks energy resources from the sea.

Chinese yards are trying to tap into the ocean engineering market, as advance payments and more bank credit are available.

Chang Jianhua, Rongsheng's vice president, told Xinhua in August that the company plans to accelerate development of ocean engineering products, which is estimated to bring 40 percent of firm's total income by 2015.

By then, the profit margin of Rongsheng's shipbuilding business is expected to rise to 20 percent from the current 5 to 10 percent. "The more difficulties, the more opportunities," said Chang.

However, ocean engineering products demand high technology, which is an achilles' heel for the country's shipbuilders, especially private yards, said Ni Tao, general manager of the China Ocean Shipping Company.

"That's why most Chinese firms are subcontractors or co-builders in the international ocean engineering market," said Ni. "We need government support to develop ocean engineering products based on home-grown technology."

Rongsheng invested heavily in a new research and development (R&D) hub in Singapore last year besides having one in Shanghai. It wants to combine foreign know-how with Chinese national identity to guarantee a sustainable revival.

"Traditionally, Singapore is a talent pool for ocean engineering product development and management. We set up the new R&D center there, which allows Rongsheng to speed up the product-development cycle," said Chen Qiang.

Experts, however, warn that the government should stop micromanaging the industry while it upgrades. Instead, it should try to ensure the market runs smoothly by establishing a level playing field and stronger rules.

"To develop ocean engineering products is the right direction, but local governments should learn lessons from last time, when they blindly gave policy support to build new yards more than what were needed," said Song.

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

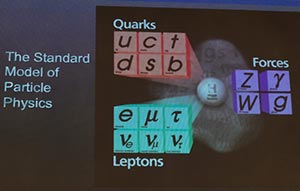

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists

Tibet expected to witness bumper harvest

Tibet expected to witness bumper harvest

Shanghai inaugurates Free Trade Zone

Shanghai inaugurates Free Trade Zone