Top 10 outbound M&A deals by Chinese companies 2014

By Sun Chengdong (chinadaily.com.cn) Updated: 2015-02-03 07:00Chinese companies grew increasingly active in overseas deal-making activity last year, according to data from Thomson Reuters.

The value of announced mergers & acquisitions (M&A) involving Chinese companies soared to record highs and amounted to $396.2 billion so far this year, a 44.0 percent increase compared to last year.

China's overseas acquisitions in Europe grew 90.8 percent to $17.7 billion compared to last year ($9.3 billion). This is the highest deal value since 2008 driven by State Grid International Development Ltd's pending acquisition of a 35 percent stake in CDP Reti Srl.

This marks the strongest-ever annual period for China-involvement announced M&A since records began in 1982.

Here are the top 10 outbound M&A deals involving Chinese companies in 2014.

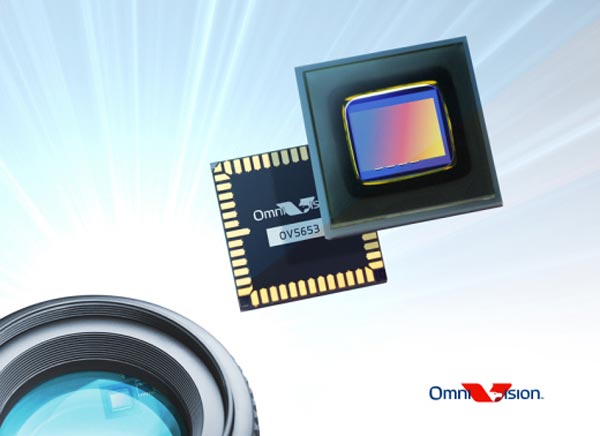

No 10 Hua Capital Management Ltd and Shanghai Pudong Science & Technology Investment Co Ltd, acquired OmniVision Technologies Inc, a US digital imaging device manufacturer.

Deal value: $1.22 billion

|

|

|

The digital imaging chips made by Omivsion. [File photo] |

- 2014 China mobile internet report

- Russian natural gas giant Gazprom given top rating from Dagong

- Okay Airways first to operate Boeing 737s

- Alibaba establishes $129 million fund in HK for startups

- S. Korean move leaves Chinese garlic farmers fuming

- There's more to Anbang story than just meets the eye

- GDP: How far can it fall?

- Top 10 outbound M&A deals by Chinese companies 2014