|

|

|

|

|||||||||||

|

Customers choose luxury watches at a high-end store in Shanghai. China is likely to become the world's largest luxury watch consumer in 2012 and have sales surpassing 210,000. [Photo / China Daily] |

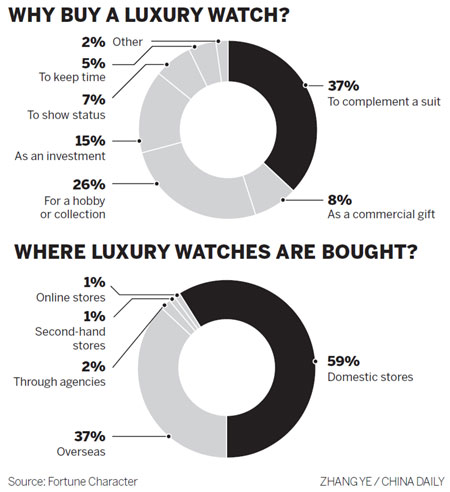

Telling time is about the last reason that affluent Chinese give for buying luxury watches, according to the China Top Wristwatch Report, released on Tuesday.

The luxury watch market is seeing "blow-out like demand" from wealthy shoppers, even though the country's general watch market is contracting as people use cellphones to keep track of time.

Instead, customers are snapping up these expensive accessories to make a fashion statement, give as business gifts or collect, according to the report published by the Shanghai-based Fortune Character luxury magazine.

"The first reason stated by our respondents for luxury watch shopping is to match their outfit.

"Telling time was the least- stated reason, accounting for 5 percent," said Zhou Ting, associate professor at the University of International Business and Economics in Beijing and lead author of the report.

The report, the first of its kind in China, surveyed 157 "frequent" luxury watch buyers in China whose annual incomes run into millions of yuan, as well as 23 executives at luxury watch brands.

In 2011, luxury watch imports rose a "striking" 49 percent to 89,575, data from the China Customs Information Center show.

This year, consumption of luxury watches is forecast to surpass 210,000, with 130,000 imported, making China the world's largest luxury watch market.

Shanghai topped the list with imports of more than 80,000 watches in 2011, or 38 times the number of Beijing, the runner-up, accounting for 93.8 percent of the national volume.

"Unlike other luxury goods like cosmetics, perfume and handbags, which are often bought overseas, 59 percent of luxury watches are bought from domestic stores," said Zhou.

That fact has propelled aggressive store expansion, especially in second- and third-tier cities, and lured in luxury brands that don't specialize in watches, such as Chanel.

There's also a middle-market clientele, who buy brands that offer models priced for urban office workers, Zhou noted.

"These people usually have no more than three wristwatches, each of a different brand. Although they contribute very little to the market (now), they would be the largest potential driving force" because of their large numbers, said Zhou.

That view is shared by Michele Sofisti, the new CEO of Gucci's Global Timepieces & Jewelry business.

"There are lots of opportunities for hardworking young people, and they are the real driving force here," Sofisti said in an earlier interview with China Daily.

Lu Chao, a 29-year-old purchasing manager from Shanghai, is one of these people.

He started with a limited edition model of Tissot's stainless steel watch while studying in the United Kingdom three years ago. Lu now has three watches, each of which cost twice as much as the previous one.

He exemplifies the study's finding about telling time: despite his multiple watches, he's often late.

"The difference between reading the time from a cellphone and a watch? Ask ladies the difference between carrying their stuff in a Wal-Mart shopping bag and a Vuitton purse," said Lu Chao.

xujunqian@chinadaily.com.cn