|

|

|

|

|||||||||||

People.cn Co Ltd, the online news portal of the People's Daily newspaper, closed more than 70 percent higher on its debut in Shanghai on Friday, as investors showed interest in the first State-owned news portal to go public on the mainland.

However, analysts warned that the company will have to maintain its high growth rate in the following years in order to maintain investor confidence and a high share price.

The stock rose 73.6 percent to 34.72 yuan ($5.51) on Friday, which helped the company raise almost three times the amount it initially sought. The benchmark Shanghai Composite Index lost 0.4 percent.

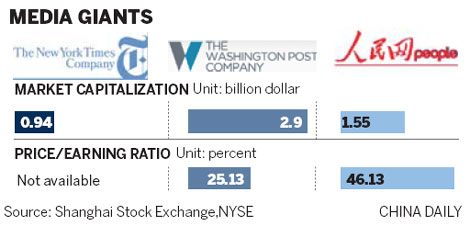

Based on this closing price, the company has a market capitalization of 9.6 billion yuan, or $1.5 billion, which is higher than that of the New York Times Co, which is valued at $938 million, but lower than the Washington Post Co's $2.9 billion.

The company started trading at 31.01 yuan per share on the Shanghai Stock Exchange, 55.05 percent higher than its IPO price of 20 yuan.

|

|

The offering has attracted a great deal of market attention as it marks the first-ever listing of a State-owned media website.

The company's IPO prospectus showed that People.cn's net profits rose to 139.48 million yuan last year from 81.65 million yuan in 2010. The major source of the profits comes from advertising, as well as information and wireless services.

Despite the surge on its first day of trading, there is likely to be a fall in the company's share price in the near future, said analysts.

"Many people were speculating on the stock, so the company's share price cannot reflect its real value," said Qiu Lin, an analyst following Internet stocks at Guosen Securities Co in Hong Kong.

The turnover rate of the stock was as high as 86 percent, which meant a large number of people sold on the first day just to make money rather than investing in the long-term development of the company, he said.

He added that the share price was too high and there is likely to be a "price reversion".

The company said it plans to use 527 million yuan from the proceeds of the IPO to improve its wireless services, purchase technological improvements and bolster its editorial team.

People.cn's IPO comes as China's State-owned portals are seeking to go public in order to compete more effectively with commercial websites such as Sina.com and Sohu.com.

Zhang Yannong, president of People's Daily, said the strong performance was a result of the company's significant "cultural value" as it strives for an integration between the newspaper and the Web portal.

The IPO of People.cn has provided more room for the development of the website, and also paved the way for the listing of cultural and media enterprises, said Zhang.

Qi Jianzhe, an analyst with the domestic research company Analysys International, said the surging share price was due to the authoritative nature of the website, government support for the cultural sector, and People.cn's efforts to develop its mobile Internet service, which is expected to be a big revenue generator.

However, "its profitability is not outstanding, compared with news portals like Sina and Sohu," said Qi. "It has to make more efforts on its profitability and business model innovation."

Sina Corp, which operates the country's biggest news portal, is valued at $3.9 billion, while Sohu.com Inc is valued at $2 billion.

People.com.cn, the main website operated by People.cn, ranked 43rd among all websites in China measured by traffic, compared with Sina's fourth place and Sohu's ninth place, according to traffic tracker Alexa.com.

Xinhua contributed to this story.

chenlimin@chinadaily.com.cn