Central State-owned enterprises are reporting that the profits of their listed units decreased in the first half of the year, and the largest declines were seen in the nonferrous metal and transport industries.

Among the 283 listed units of SOEs, 87 have released interim financial reports, according to Wind Information Co Ltd, a Shanghai-based provider of financial data, information and software.

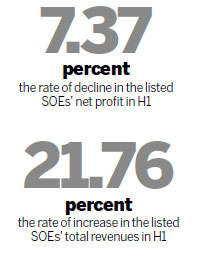

The listed companies' total revenues rose by 21.76 percent to 293.18 billion yuan ($46.09 billion) and their net profits dropped 7.37 percent to 14.95 billion yuan, data from Wind Information show.

Of the listed units of SOEs, 100 saw their profits decline or suffered losses in the first half.

Those companies made up 56.82 percent of the 176 SOEs and their listed subsidiaries that have either published interim reports or flashed first half results.

The State-owned Assets Supervision and Administration Commission now supervises 128 SOEs, most of which own listed subsidiaries.

Even though their revenues increased steadily in the first six months, 55 of the listed units of SOEs, including those of large industrial companies in the nonferrous metal and transport industries, reported losses.

Eleven out of 12 nonferrous metal companies that have released interim reports, including Shanghai-listed Aluminum Corp of China Ltd and Shenzhen-listed Jiaozuo Wanfang Aluminum Manufacturing Co Ltd, reported profits decreases or losses. The biggest cause of those results was a decrease in the prices of their products.

Backed by China Ocean Shipping (Group) Co, Shanghai-listed China COSCO Holdings Co Ltd also estimated it would have a loss totaling 2.71 billion yuan for the first half, 50 percent more than the loss it reported in the same period last year.

In comparison, the cargo company had a 19 billion yuan profit in 2007.

In a statement released late last month, COSCO blamed the huge loss on factors including the weak global economy, a slowdown in China's economic growth, an oversupply of shipping services in the international market, the low price of international dry-bulk cargo and the high price of fuel.

Companies including Shenzhen-listed FAW Car Co Ltd and Shanghai-listed China XD Electric Co Ltd also reported their first ever losses in the first half of the year.

China XD Electric Co Ltd said that overcapacity in the electric power industry and low product prices reduced the company's earnings in the first six months of the year.

In response to the decline in SOEs' earnings, SASAC has called for improved internal management and risk controls.

Shao Ning, vice-chairman of the commission, said central SOEs should prepare to go through a tough period in the next three to five years as the economy slows after undergoing 30 years of fast growth.

SOEs have been working to make improvements in the hope that those will boost their profitability after they have seen a series of earnings declines in recent years.

Earlier this month, FAW Car Co Ltd announced it will invest 4.35 billion yuan in a project at a factory that makes new-energy vehicles.

baochang@chinadaily.com.cn