The second factor is the government data report that was released last week, which showed China's trade surplus increased unexpectedly in December, demonstrating the signs of recovery in the domestic economic situation.

According to the National Bureau of Statistics, China's exports rose 14.1 percent year-on-year in December, exceeding previous expectations on a 5 percent gain and up from a 2.9 percent increase in November.

In addition, analysts expect to see more signs of improvement when China releases other government data on Friday, including factory output, investment and retail sales.

Stephane Deo, the global head of asset allocation of UBS Securities, said UBS expects the global economy to increase 3.4 percent, slightly higher than the previous year.

Deo added that majority of investors are still interested in investing in the Chinese stock market.

"As the stock market is still recovering, new emerging market will receive the largest effects, and provide the most potential for investments," Deo said.

The third factor is the overseas market.

The Japan government announced on Jan 11 a $224 billion stimulus plan to overcome deflation and boost its economy.

According to the Japanese government, this stimulus plan will boost its domestic GDP by about 2 percent this year, and create about 600,000 jobs .

After the announcement, Japan's stock market index increased by 1.4 percent to 10,800 points, its highest level since February 2011.

There are more reasons behind the revival of the Chinese stock market, the UBS said.

"I am quite confident with the valuation of the A-share market, which will recover with the increase on price-earnings ratio from eight times to higher than nine times," Chen said.

Chen added that the risk premium of the A-share market reached a historical peak in December, and the valuation of risk premium has started going down with a strong performance of A shares, and the overall liquidity for the market in 2013 is getting much better than in 2012.

In addition, "as the financing products supplied by the banks will be monitored with regulations by the government for the year, diverted capital will come back to the A-share market", Chen added.

Zhang Qi, an analyst with Haitong Securities Co Ltd, also was optimistic about the market.

"The economic situation has started recovering since December, so the stock market is also warming up," he said.

The recovery of the market is caused by the loosening monetary policy and the improving economic environment, he said.

Zhang predicted that shares will continue to rebound before Spring Festival, which is on Feb 10.

Contact the writers at yuran@chinadaily.com.cn and huangtiantian@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

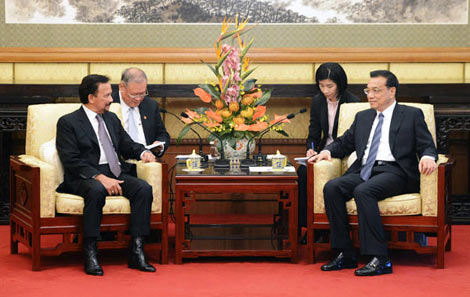

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show