In addition, the macro control policies for the property market have been in place since April 2010 and have depressed rigid demand for some time. The rising sales of apartments at the end of last year might be a release of rigid demand, said Ren.

Ren concluded that lowering of interest rates, expectations that the government might loosen control policies, pro-growth macro policies, the push from local governments' and the change in household purchasing power may have all contributed to the rising housing prices.

Ren said there are reasons to support a stable property market for this year, including the Chinese government's clear signal that it will not loosen control, release of the rigid demand, a high inventory of developers and the fact that more government-subsidized apartments will be put into use this year.

She added that the uncertainty in macro policy and the possible loosening of monetary policy at a time when China's inflation rises high may all have an impact on the property market.

Yu Bin, director of macroeconomic research at the Development Research Center of the State Council, predicted at the conference that the Consumer Price Index, a main gauge of inflation, may go up from 2.6 percent in 2012 to 4 percent this year.

Related Readings

China's property investment up 16.2% in 2012

China's property tax trial expansion in doubt

Property developers' sales see solid growth in 2012

Beijing's Dec property sales to reach record high in 2012

Property curbs to stay in place for 2013

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

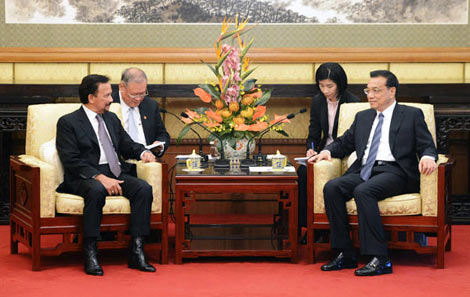

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show