China may start to tighten its credit policy as the economy recovers, inflation and property prices rise further and concerns about over-investment and financial sector health return, investment bank UBS said in a report on Thursday.

China's monetary policy was eased in mid-2012 and credit expansion has been very rapid since then.

"The earliest possible opportunity for reining in credit will likely be April, but we think the more likely time would be in the second half of 2013," said Wang Tao, an economist with UBS. "As for policies regarding the property sector, we think some targeted measures could be implemented as early as April 2013 for a few large cities if sales and prices continue to rise rapidly."

This is not the whole story, of course. This year will likely see many sector-specific or structural policy changes being initiated or implemented, the bank said.

While they are not trailblazing big moves, these policy changes will have an important and uneven impact on different sectors and on the market. Many of these will be the new administration resuming policy changes outlined in the 12th Five Year Plan (2011-15) after a period of leadership transition, it said.

In general, these policies tend to have a negative impact on energy-intensive sectors, including State-owned companies, and are positive for utilities, transport and services, and general consumption, it added.

However, the near-term direction of credit and property policies and the implementation of key structural reforms in the next two to three years will determine whether such "rebalancing" policies can achieve the desired effects, Wang said.

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

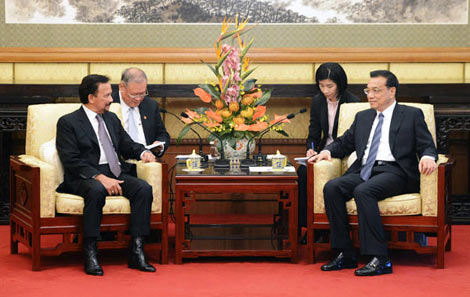

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show