|

|

|

A small-sum loan company in Wenzhou, Zhejiang province, in April 2012. By the end of last year, there were 6,080 small-sum loan companies in Chinaa, extending a total of 592.1 billion yuan ($95.25 billion) of loans. [BAI LINMIAO / FOR CHINA DAILY] |

By all accounts, Dai Tianrong, the chairman of Zhejiang Youcan Foods Group Co Ltd, could be a major local financier in Hangzhou, the capital of Zhejiang province famous for its private business.

His company is not only a leading food manufacturer, but also a major warehouse and delivery services provider to more than 70 grocery food companies, mostly small and micro sized enterprises.

Dai has detailed information on his clients' credit records, has sufficient cash reserves, and his company's track record of success represents a solid prospect for getting bank loans.

In other words, he meets every criteria to be the perfect entity to channel liquidity from banks to thousands of local firms.

However, though Dai has provided some loans to his clients, his borrowing capability has been constrained by some of the conditions surrounding small-sum loan companies like his, under China's current financial system.

By the end of last year, there were 6,080 small-sum loan companies in China, extending a total of 592.1 billion yuan ($95.25 billion) of loans.

But a series of problems related to their status, including heavy tax liabilities, loan ceilings, and an inability to absorb savings, are stifling their development.

As non-bank companies registered with the Administration for Industry and Commerce, under China Banking Regulatory Commission rules small-sum loan companies are unable to enjoy the favorable policies enjoyed by "financial institutions".

With ordinary taxes are company status, their turnover tax is collected based on their borrowing rate.

In contrast, the turnover tax of financial institutions is levied according to the margin between the borrowing rate and deposit rate.

This, combined with a 25 percent corporate income tax rate, accounts for one-third of small-sum loan company profits, said Zheng Jianjiang, the president of Aux Group, an electrical appliance manufacturer in Zhejiang.

Lu Rong, general manager of Risheng Small-sum Loan Co in Wenzhou, a private entrepreneur hub, said the current profit margin in his industry is generally 10 to 12 percent, not taking into consideration any bad loans provision.

"Lenders feel that the lending rate, which is four times that of the benchmark interest rate, is too high. But our actual profit is not high," Lu said.

Related Readings

Lending companies to get boost

Small-loans firm opens in Harbin with focus on Sino-Russian trade

Private lending disputes to increase

Final approval sought for Wenzhou private-financing regulation

Filling the gap in Wenzhou's finance market

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

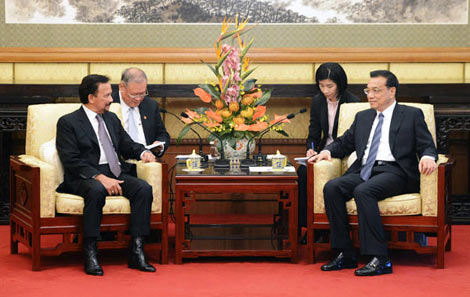

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show