The CSRC said the contract will help steel companies and coal and coke producers to hedge price risks of raw materials.

Jiang Zhimin, vice-president of the China National Coal Association, said the contract will lead to a more reasonable pricing mechanism for coking coal and help prevent price fluctuations.

Dramatic price fluctuations in the international market have brought much pressure to Chinese producers, said Wang Shouzhen, chairman of the coal industry association in Shanxi province, the major coking coal production area in the country.

"The companies will gradually learn how to make use of the contracts to avoid the risks caused by price volatility," said Wang.

Dalian Commodity Exchange, in Liaoning province, started trading the world's first metallurgical coke futures last year.

It said that it expected spot trading companies to actively participate in the new trading mode, and is working on expanding market training on the introduction of the new contracts.

However, analyst said that even though it was a good idea to connect whole industrial chains - coal, coke and steel - the exchange still faces a challenge to increase trading volumes.

"Coking and coal chemical companies have not shown much interest in the new contract so far," said Dai Bing, director of the coal industry information department at JYD Online Corp, a Beijing-based bulk commodity consultancy.

Xiang Hongjin, Sinochem Division Manager at Guan Tong Futures Co Ltd, said it takes time for companies to accept new contracts coming to the market.

She said the exchange had had a relatively big trading volume on the first day, of about 730,000 tons, but expected that to remain weak in the medium to long term.

Zhu Chengpei in Dalian contributed to this story

dujuan@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

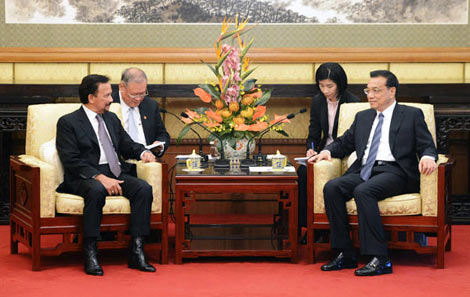

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show