O'Neill continues to put his confidence in emerging markets, remains bullish on China, and believes the country's slowing 2012 growth will pick up in 2013.

O'Neill first came to China in 1990, and since then has witnessed profound changes and transformations in the country. He shaped an era for Goldman Sachs Asset Management by shifting focus from G7 countries to emerging markets, particularly China.

"The importance and scale of China for the world, never mind within the BRICS group, is next to none and vital for us all," he said.

As a result, he said, the decisions China makes — both in its own right and within a BRICS context — are extremely important.

"This decade, China will grow by around 7.5 percent (annually) and I am happy with that."

He is also a bit surprised by the weakness of the retail sales numbers reported this year, which suggests that China needs to boost consumption, which might need more policy support.

Assuming the Chinese government does pull that off, O'Neill said it would mean China will succeed in doubling both real GDP and real incomes this decade as planned, and this would be good for the world.

Other BRICS countries, O'Neill said, need to concentrate on their own priorities rather than worry about China, as they also have things to achieve.

zhangchunyan@chinadaily.com.cn

Related Readings

BRICS bank holds promise

BRICS summit raises hopes

BRICS to mull development bank, forex reserve

BRICS development bank likely to focus on infrastructure

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

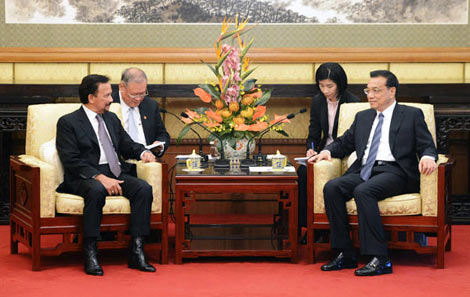

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show