|

A natural gas facility in Puyang, Henan province. China is expected to benefit from US exports of shale oil and shale gas due to their impact on global energy prices. [Photo/China Daily] |

The global supply of unconventional energy sources will triple by 2030 compared with 2011 levels, which will have a major impact on the international energy market and benefit China, BP Plc said in an outlook released in Beijing on Thursday.

Global energy demand will rise 36 percent by 2030 compared with 2011 with almost all of the growth coming from emerging economies, it added.

"Unconventional sources - shale gas and light oil together with heavy oil and biofuels - will play an increasingly important role and transform the energy balance of the United States," said Zhang Chi, head of the Asian economics department at BP.

Growing production from unconventional sources is expected to contribute more than 70 percent of the net growth of the global oil supply by 2030.

Increasing production and weaker demand will result in the US being 99 percent self-sufficient in net energy by 2030, while it was only 70 percent self-sufficient in 2005.

And although the US is the biggest beneficiary of the shale gas "revolution", China will benefit from it to some extent, experts said.

Exports of US shale oil and shale gas will help cap international oil prices, which is good news for oil importers, said David Robinson, senior research fellow with the Oxford Institute for Energy Studies.

He told China Daily on Thursday that because the geological conditions of US shale gas blocks are favorable, shale gas companies there will be able to adjust their production plans according to international crude oil price fluctuations.

Christopher Allsopp, director of the institute, said, "The increasing shale gas supply from the US cannot promise cheap energy, but it has its impact on the natural gas pricing mechanism."

Natural gas prices in Asia are now linked to international crude oil prices, but that link is set to blur as natural gas is more likely to be priced, as in other markets, on supply and demand, he said.

For China, the increasing output of US shale gas has given the country a bigger say during talks with Russian natural gas suppliers, said Keun-Wook Paik, another senior research fellow at the institute.

During President Xi Jinping's visit to Russia this month, the two countries reached an agreement that Russia will export 38 billion cubic meters of natural gas annually to China starting in 2018.

Paik said the success of the deal is heavily related to the US' lower energy demand, caused by its increasing shale gas output.

"Russia is eager to find buyers for its natural gas resources," he said. "In addition to the US, Europe has also reduced its gas imports, which has made China look like a very promising buyer."

"Another positive impact of the US' shale gas revolution is that it has provided China more opportunities to look for more overseas energy resources where the US is less interested in," said Robinson.

China is strongly dependent on Middle East's oil imports and the country should diversify its energy supply channels, said Xu Qinhua, executive director of the Center for International Energy Strategy Studies at Renmin University.

According to the BP report, China will become the most successful country in terms of shale gas development in addition to the US and Canada.

By 2030, China's shale gas output will increase to 6 billion cubic feet a day, accounting for 20 percent of the country's natural gas output, the report said.

However, China's shale gas development will be an evolution rather than a revolution, Zhang noted.

Shale gas supplies are expected to meet 37 percent of the growth in natural gas demand and account for 16 percent of the world gas output by 2030, the BP report added.

It said that North America's shale gas production growth will slow after 2020, while production from other regions will increase gradually.

dujuan@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

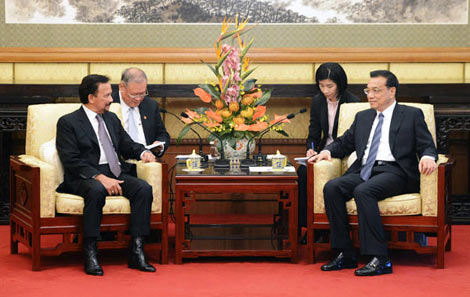

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show