Nonperforming loan ratio rises among top 10 listed lenders

The nation's third-largest lender, Agricultural Bank of China Ltd, will sell nonperforming assets valued at 10 billion yuan ($1.6 billion), the bank said on a briefing on Thursday.

ABC is to sell 19 properties used as collateral, along with seven loans, on the Beijing Financial Assets Exchange, the lender said.

Analysts said that more Chinese lenders may sell nonperforming assets as banks face pressure from souring debts amid an economic slowdown.

|

An Agricultural Bank of China Ltd outlet in Nanjing. ABC had the highest NPL ratio among the nation's 17 publicly traded lenders, according to first-half earnings reports on the China Banking Regulatory Commission's website. Provided to China Daily |

According to statistics from PricewaterhouseCoopers China, outstanding delinquent loans held by the top 10 listed banks stood at 585.8 billion yuan at the end of June, up 20.42 percent from the end of 2012.

The delinquent loan ratio rose from 1.21 percent at the end of 2012 to 1.35 percent at the end of June. The increase signals a possible later rise in NPLs.

The top 10 listed banks are ABC as well as Industrial and Commercial Bank of China, China Construction Bank Corp, Bank of China Ltd, Bank of Communications Co Ltd, China Merchants Bank Co Ltd, Industrial Bank Corp Ltd, China Minsheng Banking Corp Ltd, Shanghai Pudong Development Bank and China Citic Bank International Ltd.

ICBC (the world's most profitable lender), CCB, ABC, BoC and BoComm are the five largest lenders in China. They wrote off 22.1 billion yuan of debt that couldn't be collected as of the end of June, 7.65 billion yuan more than in 2012, according to their exchange filings.

ABC had the highest NPL ratio among the nation's 17 publicly traded lenders, according to first-half earnings reports on the China Banking Regulatory Commission's website.

ABC's other latest news

Agricultural Bank to open branch in Frankfurt

Agricultural Bank sees profit rise

Agricultural Bank of China Q1 net profit up 8%

We further recommend

Li pledges to strengthen debt audits

World's first 1-liter car debuts in Beijing

World's first 1-liter car debuts in Beijing

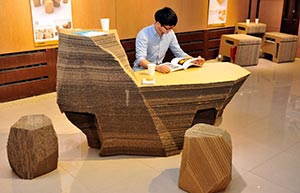

Paper-made furniture lights up art show

Paper-made furniture lights up art show

Robots kick off football match in Hefei

Robots kick off football match in Hefei

Aerobatic team prepare for Aviation Convention

Aerobatic team prepare for Aviation Convention

China Suzhou Electronic Manufacturer Exposition kicks off

China Suzhou Electronic Manufacturer Exposition kicks off

'Squid beauty' and her profitable BBQ store

'Squid beauty' and her profitable BBQ store

A day in the life of a car model

A day in the life of a car model

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing