|

|||||||||||||||

|

Major Macro Economic Statistics

|

||||||||||||||

| Growth indexes | Price indexes | ||||||||||||||

| GDP in Q4:+9.8% | CPI:+4.6% | ||||||||||||||

| Industrial output:+13.5% | PPI:+5.9% | ||||||||||||||

| Retail sales:+19.1% | PMI:53.9 | ||||||||||||||

| Urban fixed-asset investment in 2010:+23.8% | Housing prices:+6.4% | ||||||||||||||

| FDI:+15.6% | Foreign trade indexes | ||||||||||||||

| Financial indexes | Import:+17.9% | ||||||||||||||

| New loans:480.7b yuan | Export:+25.6% | ||||||||||||||

| M2:72.6t yuan ($11t) | Trade balance:$13.1b | ||||||||||||||

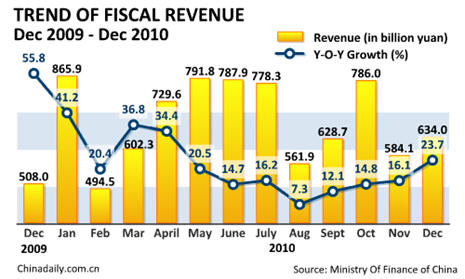

| Fiscal revenue: +23.7% | |||||||||||||||

|

CHINA ECONOMY BY NUMBERS (Monthly Issue)

|

|||||||||||||||

| January | February | March | |||||||||||||

| April | May | June | |||||||||||||

| July | August | September | |||||||||||||

| October | November | December | |||||||||||||

| Data and Graphic | |||||||||||||||

|

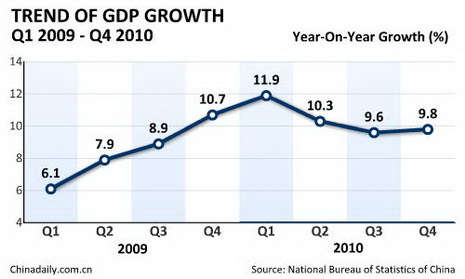

China's economy grows 10.3% in 2010 China's economy resumed annual double-digit growth by expanding 10.3 percent last year, the National Bureau of Statistics (NBS) announced on Jan 20. Gross domestic product (GDP) hit 39.8 trillion yuan ($6.05 trillion) last year, Ma Jiantang, director of the NBS, told a news conference. In the fourth quarter, GDP growth picked up to 9.8 percent year-on-year from 9.6 percent in the third quarter, after slowing from 11.9 percent in the first quarter and 10.3 percent in the second. [Full story] |

||||||||||||||

|

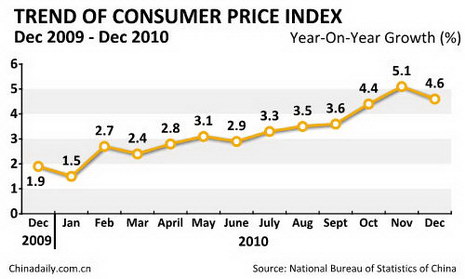

China's CPI up 4.6% in Dec 2010 China's consumer price index (CPI), a main gauge of inflation, rose 4.6 percent in December year-on-year, the National Bureau of Statistics (NBS) announced on Jan 20. The CPI was up 3.3 percent in 2010 from the previous year, the NBS said. The monthly figure was slightly lower than November's 5.1 percent, a 28-month high, but slightly higher than October's 4.4-percent growth. The prices of food, which accounts for a third of the basket of goods in China's CPI calculation, surged 7.2 percent year-on-year in 2010. [Full story] |

||||||||||||||

|

China's PPI up 5.5% in 2010 China's producer price index (PPI), a major measure of inflation at the wholesale level, rose 5.5 percent last year, the National Bureau of Statistics (NBS) announced Thursday. The December PPI rose 5.9 percent year on year and 0.7 percent from November, the NBS said. The PPI rose 6.1 percent year on year in November, compared with a 5-percent gain in October. [Full story]

|

||||||||||||||

|

Home prices in 70 major cities up 6.4% in Dec Home prices in 70 major Chinese cities rose 0.3 percent month on month in December and 6.4 percent year-on-year, the National Bureau of Statistics (NBS) said on Jan 17. The annualized growth rate dropped from 7.7 percent in November, making December the eighth consecutive month of slowing growth from a peak of 12.8 percent in April last year, when the government stepped up controls to curb prices. New home prices climbed 7.6 percent year-on-year last month and 0.3 percent month-on-month, while prices for second-hand homes rose 5 percent year on year and 0.5 percent month on month, said a statement on the NBS website. [Full story] |

||||||||||||||

|

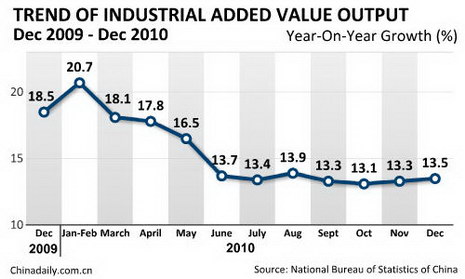

Industrial added value output up 15.7% in 2010 China's industrial added value output was up 15.7 percent in 2010, the National Bureau of Statistics (NBS) announced at a news conference on Jan 20. The industrial added value output rose 13.5 percent year-on-year in December 2010, the NBS said. [Full story] |

||||||||||||||

|

China's fixed-asset investment up 23.8% in 2010 China's urban fixed-asset investment rose 23.8 percent year on year in 2010, the National Bureau of Statistics said at a news conference on Jan 20. China's urban fixed-asset investment rose 30.1 percent year on year in 2009. [Full story] |

||||||||||||||

|

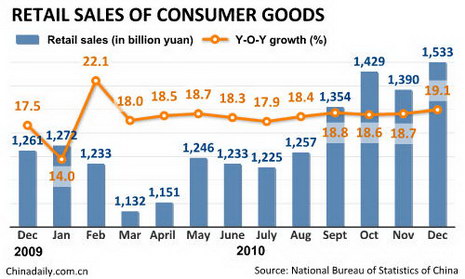

China's retail sales up 18.4% in 2010 China's retail sales rose 18.4 percent year-on-year to 15.4554 trillion yuan ($2.34 trillion) in 2010, the National Bureau of Statistics (NBS) said at a news conference on Jan 20. Ma Jiantang, chief of NBS, told the news conference that the growth rate of retail sales was 14.8 percent in real terms after deducting the price factor. China's consumer price index, a main gauge of inflation, went up 3.3 percent for the full-year in 2010 from the previous year, according to NBS. [Full story] |

||||||||||||||

|

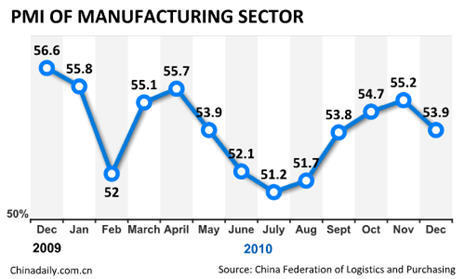

December PMI signals inflation is leveling off China's factory inflation cooled in December as manufacturers expanded more slowly after a strong run in growth, lessening the need for the country's central bank to tighten monetary policy too far. The official Chinese purchasing managers' index (PMI) edged down to 53.9 in December from November's 55.2. The results of the survey of 820 firms will likely be welcomed by China's central bank by showing the world's second-largest economy was still growing solidly despite the slight pull-back in activity. [Full story] |

||||||||||||||

|

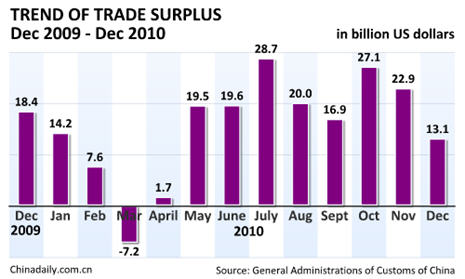

China's trade surplus hits $183b in 2010 China's foreign trade in 2010 jumped 34.7percent from a year earlier to $2.97 trillion, while trade surplus fell 6.4 percent to $183.1 billion from the 2009 level, the General Administration of Customs (GAC) said on Jan 10. In a breakdown, the country's exports grew 31.3 percent year-on-year last year to $1.58 trillion while imports surged 38.7 percent to $1.39 trillion, said the GAC. "China's foreign trade is, in general, heading towards a balanced structure," said the GAC in a statement on its website. [Full story] |

||||||||||||||

|

China's new yuan-denominated loans hit 7.95t yuan in 2010 New yuan-denominated lending in China reached 7.95 trillion yuan ($1.2 trillion) last year, the People's Bank of China (PBOC), the central bank, said on Jan 11. The figure was 1.65 trillion yuan less than the 2009 level, said the bank in a statement on its website. New yuan-denominated loans in December last year stood at 480.7 billion yuan. [Full story] |

||||||||||||||

|

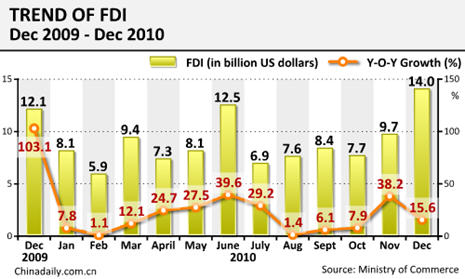

China's 2010 FDI hits $105.74b, up 17.4% Foreign direct investment (FDI) into China hit a record $105.74 billion last year, up 17.4 percent year-on-year, the Ministry of Commerce (MOC) announced on Jan 18. In December alone, China attracted $14.03 billion of FDI, up 15.6 percent year-on-year, making it the 17th consecutive month of FDI growth since August 2009. The rapid FDI growth could be attributed to robust development in the service sector and the country's central and western regions, said MOC spokesman Yao Jian. [Full story] |

||||||||||||||

|

China's 2010 fiscal revenue reaches $1.26t China's Ministry of Finance said on Jan 20 that the nation's fiscal revenue grew 21.3 percent year on year to 8.31 trillion yuan ($1.26 trillion) last year. Of the total, the central fiscal revenue topped 4.25 trillion yuan, up 18.3 percent from the previous year, while local governments collected 4.06 trillion yuan, up 24.6 percent, the ministry said in a statement on its official website. The fiscal revenue for last December surged 23.7 percent year on year to reach 634 billion yuan, the ministry figures showed. [Full story] |

||||||||||||||

| Round Table | |||||||||||||||

|

To raise interest rates again before the new year will help China stabilize inflation expectations next year. It will also help curb domestic property price bubbles. The series of policies and measures adopted by the relevant State departments over the past months have curbed the momentum of soaring prices. It is expected that the CPI growth rate in December will fall from the 5.1 percent of November, which was a record high over the past 28 months. [Full story] |

It is true that in the long run sustained monetary expansion drives up inflation. The inflation outlook does not seem problematic enough to warrant surpressing overall inflation by administrative measures or postponing needed price adjustments. High inflation is distortive and not helpful. However, in rapidly growing countries like China, relative prices need to change to facilitate changes in the economic structure. [Full story] |

||||||||||||||

|

Monetary over-supply has undoubtedly fuelled price rises, which, together with speculation by investors, has continuously pushed up the price of properties and consumer commodities. In addition, trade surplus and the inflow of hot money have also added to China's over fluidity. [Full story] |

The recent rises in commodity prices and looming inflation have become of increasing concern, not just to the Chinese government, but also to many ordinary people.

|

A country with current-account and capital-account surpluses and increasing foreign-exchange reserves normally sees excessive money supply and high inflation. The real monetary base is actually much smaller than it appears. As a result, China's inflation, as well as asset prices, remains under control. [Full story] |

|||||||||||||

|

It is somehow convinced that the rise in prices in the recent past was a reflection of structural adjustment, not overall inflation. The problem, according to government argument, did not require monetary policy action. Unless the central bank changes its current policy approach, inflationary pressure is likely to rise further, at least in the first half of this year. But the rapid increase in inflation should eventually make policymakers change their stance, because they are certainly worried about the political consequences of high inflation. We could see high inflation in the first half of the year and aggressive policy tightening in the second half, including interest rate hikes, currency revaluation and tightening liquidity. And such measures should exert some downward pressure on inflation, asset prices and economic growth. [Full story] |

|||||||||||||||