China's economy will hum along at a growth rate of 8 percent in 2013, modestly faster than last year, as the country embraces its new leadership, several Chinese economists predicted at a forum at the New York Stock Exchange on Monday.

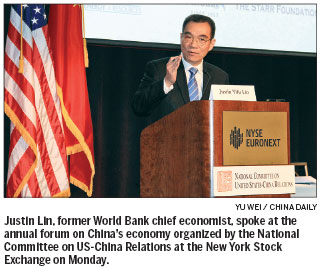

The annual forum, organized by the National Committee on United States-China Relations, drew more than 100 people in the financial-services industry seeking insights about the world's second-biggest economy amid the ongoing political transition.

|

Justin Yifu Lin, a former World Bank chief economist and senior vice-president, predicted China would see its gross domestic product expand by 8 percent to 8.5 percent in 2013. The country is likely to maintain similarly rapid growth over in the next 5 to 10 years, he said.

"But as a developing country and a transitional economy, China certainly faces many challenges to tap into this potential," Lin told a group of reporters during the forum.

Even with the best economic models as measurement, Lin said, the Chinese economy is like a glass that's half-full or half-empty, depending on how it's viewed.

His GDP forecast was based on China's quest for growth driven by consumption of the growing middle class as well as expected acceleration from the comparatively slow growth of 2012.

Among the challenges China faces, according to Lin, are income disparity and corruption, which combined could produce social tensions, and the need to exert discipline in tackling these problems.

The influential economist said the new Chinese leadership understands these and other challenges. The 18th National Party Congress in November sent "positive signals" in that regard.

"China will try to do this kind of marginal reform," Lin said. "You have to be patient. It may not be as rapid as you hope. But China is very close to a well-functioning market economy."

He also called growth in China a "win-win" for itself and the United States, because the latter can help boost employment by increasing exports to the Asian nation.

The Chinese economy grew 7.4 percent during last year's third quarter, the seventh consecutive period of steadily slower pace. But the fourth quarter, which ended Dec 31, will likely have turned that around, due to greater domestic consumption and infrastructure investment, according to a report by the Institute of Economic Research at China's Renmin University.

Wang Jianye, chief economist at the Export-Import Bank of China who took part in Monday's forum at the NYSE, said predictions of an economic "hard landing" for China in 2012 were exaggerated.

"China's domestic market is growing rapidly, and this will remain a key driver for the country to maintain its economic growth," Wang said. "While domestic investment has and will generate economic growth in coming years, China's stable fiscal policy will also help the country's stable growth."

yuweizhang@chinadailyusa.com