Rethinking Sino-US ties

(China Daily) Updated: 2014-07-08 07:31Senior US and Chinese officials will gather in Beijing for the sixth Strategic and Economics Dialogue (S& ED). With bilateral frictions mounting on a number of fronts - including cyber security, territorial disputes in the East China Sea and South China Sea and currency policy - the summit offers an opportunity for a serious reconsideration of the relationship between the world's two most powerful economies.

The United States and China are locked in an uncomfortable embrace - the economic counterpart of what psychologists call "codependency". The association started in the late 1970s, when China was recovering from the "cultural revolution" (1966-76) and the US was mired in a wrenching stagflation. Desperate for economic growth, two needy countries entered into a partnership on the economic front.

China benefited from an export-led economic model that was critically dependent on the US as its largest source of demand. The US gained by turning to China for low-cost goods that helped income-constrained consumers make ends meet; it also imported surplus savings from China to fill the void of an unprecedented shortfall of domestic savings, with the deficit prone US drawing freely on China's voracious appetite for Treasury securities.

Over time, this association morphed into a full-blown and inherently unhealthy codependency. Both partners took the relationship for granted and pushed unbalanced growth models too far - the US with its asset and credit bubbles that underpinned a record consumption binge, and China with an export-led resurgence that was ultimately dependent on America's consumption bubble.

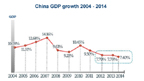

The imbalances only worsened. China's three decades of 10 percent annual growth led to unsustainable strains - outsize resource and energy needs, environmental degradation and pollution, and mounting income inequality. Huge Chinese current account surpluses resulted from too much savings and too little consumption.

Mounting imbalances in the US were the mirror image of those in China - a massive shortfall in domestic savings, unprecedented current account deficits, excess debt and an asset-dependent economy that was ultimately built on speculative quicksand.

Predictably, in keeping with the pathology of codependence, the lines distinguishing the two countries became blurred. Over the past decades, Chinese subsidiaries of Western multinationals accounted for more than 60 percent of the cumulative rise in China's exports. In other words, the export miracle was sparked not by State-owned Chinese companies but by offshore efficiency solutions crafted in the West. This led to the economic equivalent of a personal identity crisis: Who is China - them or us?

In personal relationships, denial tends to mask imbalances, but only for so long. Ultimately, the denial cracks and imbalances give rise to frictions and blame, holding a codependent partner responsible for problems of one's own making. Such is the case with the US and China.