Role of emerging economies

By Yao Zhizhong (China Daily) Updated: 2014-07-14 07:23They've been making efforts to contribute to the establishment of a mechanism to coordinate economic cooperation among themselves

Of late, the emerging economic entities such as the BRICS grouping of Brazil, Russia, India, China, and South Africa, are being increasingly greeted with skepticism, as a result of the decelerating economic growth rates of some of the previously fast-growing emerging economies. However, it would be foolish to underestimate the significance of the BRICS in global governance simply because of this. As a matter of fact, BRICS is playing a considerable role in boosting the global economy, and its members are coordinating to handle intractable issues with regard to the long-term potential of global economic growth.

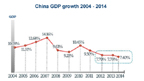

China is the largest BRICS economy, and, even though its growth rate has slowed, it is still expected to have a growth rate of around 7 percent over the next five to 10 years. This is much higher than that of many advanced economies, including the United States and European countries, which are only expected to grow by 2 to 3 percent.

India, meanwhile, is yet to reach middle-income levels, or the middle-income trap, where a country gets stuck at a certain income level. In other words, India's fast economic growth will last for a while, as it is still breaking out of its poverty trap.

Albeit, they are each encountering different economic problems, Russia, Brazil, and South Africa are all benefiting from the BRICS mechanism to varying degrees, and it has helped them avoid getting stuck in deeper trouble. Russia, which is now facing the challenge of sanctions imposed by the US and the European Union in response to its actions in Ukraine, could be exempted from many of the potential consequences thanks to its cooperation with other BRICS members. For instance, the emergency foreign exchange reserve mechanism among the five countries better empowers them to address crises, especially a self-fulfilling crisis of confidence in their governance. Additionally, a new BRICS development bank, aimed at providing investment and financing for infrastructure to all member states, is expected to be officially launched at the BRICS summit in Brazil, which starts on Monday.

The bank, which will be launched with $50 billion in capital, is a proactive response to the flawed global governance mechanism, after the G7, consisting of Canada, France, Germany, Italy, Japan, the United Kingdom and the US, revealed it was unable to deal with global economic affairs when challenged by the US financial crisis in 2008.

And with reform of the International Monetary Fund proceeding at a glacial pace, and the World Bank facing difficulties raising funds for large-scale development financing, the development bank and the expected blueprint for establishing of a $100 billion reserve fund to fend off currency and balance of payments crises, will ensure the means for monetary policy more in tune with the realities of emerging economies.

To reduce the dependency on the US dollar as the dominant currency in international trade, all BRICS states are also embarking on local currency settlements.

Moreover, the liberalization of international trade and investment, and the negotiation of international economic rules, are progressing slowly within the framework of the World Trade Organization. And a legally binding global agreement on climate change is still out of sight. Yet, BRICS is actively seeking to change the current global governance order, with a mechanism that is cooperation oriented.

Last but not the least, further cooperation in improving cybersecurity will be a major focus of all BRICS states, all of which are inclined to alleviate dependence on Western technologies, since none of the international institutions has been able to address the issue of the US' pervasive cybersurveillance, as revealed by the ex-US National Security Agency contractor Edward Snowden.

The cooperative moves of the BRICS members show that they are making efforts to ensure the mechanism plays a more active role in global affairs. Particularly since it is BRICS' first financial entity and there has been some disagreement over the practical details such as the location of its headquarters, the launch of the development bank is bound to enhance and consolidate the current BRICS mechanism, which will not only be beneficial to fairer global governance, but also to the domestic development of the member states themselves.

The author is the deputy director with the Institute of World Economics and Politics at the China Academy of Social Sciences.