Slow but steady approach yields fruit

By Swaran Singh (China Daily) Updated: 2014-07-14 07:23The sixth summit of BRICS (Brazil, Russia, India, China and South Africa) this week is expected to take the first concrete step in showcasing its system shaping capacities and skills. Among other deliberations on evolving a new global financial order, BRICS leaders are expected to launch two new institutions - a development bank, which some are calling a mini-World Bank and a contingent reserve arrangement, which is also being described as a mini-IMF. Both these would mark a drift away from the monopoly of the US-dominated multilateral lending agencies of the G7 economies and herald a paradigm shift in global economic decision-making.

Both institutions aim to reach $100 billion reserves, though this will happen over a long period of time. The development bank will begin with a modest contributions of $10 billion from each of the five countries, which will give it starting capital of $50 billion. Of this $50 billion, only part will be contributed immediately by each country, while the rest will be callable capital. These low contributions seek to ensure the equal participation of the BRICS members. The bank is due to begin disbursing funds in 2016. To reach $100 billion, it will be simultaneously opened for participation by other UN member states, although the BRICS countries intend to ensure that these new members do not get more than 45 percent of the stakes in order to keep control of the bank's policies.

They have evolved a far more innovative approach to their second institution, the contingent reserve pool or currency swap fund. The plan is for China to contribute $41 billion, Brazil, Russia, and India $18 billion each and South Africa $5 billion. Their drawing rights will be proportional to their contributions, but these will be only 50 percent of its contributions in case of China, 100 per cent for Brazil, Russia and India and 200 percent for South Africa. These contributions will also be as yet only in the form of commitments and actual funds will only flow when required.

As regards their mandate, while the BRICS Development Bank will seek to finance long term infrastructure projects across developing countries, the contingent reserve will provide an emergency cushion of cash for the BRICS countries should there be a currency crisis, triggered by, say, the sudden evaporation of foreign investments or by a rising current account deficit. However, both remain very small compared to the World Bank which has a total capital of $223 billion, or even the Asian Development Bank that has total capital of $165 billion. The same is true of the International Monetary Fund which is notorious for attaching political strings to its economic assistance; often transforming target state's economic structures and even politics by imposing Western models of human rights.

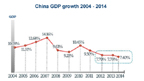

The pace with which BRICS is introducing these two initiatives should enable them to overcome the multiple hurdles flowing from both the diverse makeup of BRICS and the systemic tremors arising from their challenge to the status quo under the governance of the G7. In spite of limited focus, their diverse economic sizes will have to be kept in mind. China accounts for over half of BRICS combined GDP and over three-fourths of its foreign exchange reserves. But Beijing's desire to use its financial assets to redefine global financial decision-making generates scepticism among other BRICS members, especially in New Delhi. Starting from their summit in New Delhi in 2012, when the bank and contingent reserve were first put on the table, BRICS have gradually resolved several of their contentions with regards to contributions, management, membership, but the issue of whether the bank will be located in New Delhi or Shanghai is still to be resolved at this summit.

Will making a choice between New Delhi and Shanghai become their next flashpoint? There are three reasons why this is unlikely. First, in a multilateral context, both China and India invariably display a strong sense of shared understanding. Second, the implications of their decisions for the global financial architecture makes any bilateral considerations appear myopic. Third, in multilateral discussions it is normal for the able participant to make concessions to achieve effective and efficient consensus and Beijing has demonstrated this in BRICS several times.

In addition to the FIFA World Cup, it is important to understand the larger context which is likely to generate bonhomie at this summit. Other than the global economic slowdown since 2008, the continued reluctance of the United States Congress to ratify the 2010 plan to raise the influence of emerging nations in the IMF, followed by threats of the flight of capital impacting Chinese and Indian currency markets during 2013, and more recently, Western economic sanctions against Russia and the latter's exclusion from the G8, are the backdrop for the BRICS summit in Brazil.

BRICS must avoid falling prey to political rhetoric. As it takes the first steps to transform the global financial architecture it must bear in mind that, even with China, BRICS as yet constitutes no more than one-fifth of the global GDP and is less than half the GDP of the G7 economies.

The author is professor of international relations at Jawaharlal Nehru University, New Delhi.