Film quality, not capital, decides success

By Zhu Jin (China Daily) Updated: 2014-08-30 08:05The cultural industry, including the film industry, has been attracting increasing amounts of capital from other industries. But more money does not necessarily translate into more good contents.

Film production is one of the most capital-intensive businesses. Fifteen film companies have been listed since Huayi Media Group, the largest private film company in China, went public in 2009. The new funding the industry has raised from the capital market has fueled its nearly 30 percent annual growth in the last few years. Still more companies are expected to join the race for funding, as China Securities Regulatory Commission figures show at least 10 other film and TV companies are waiting to be listed this year.

The flow of capital has, no doubt, stimulated the development of movies both in terms of number and quality. Last year can be considered a turning point for the domestic film industry, because Chinese films accounted for 58 percent of the 21.7 billion yuan ($3.6 billion) box office returns, up from 48 percent in 2012.

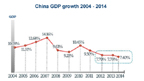

"Statistics show that when a country's per capita GDP exceeds $5,000, expenditure on cultural products will enjoy rapid growth. Since China's per capita GDP crossed $6,700 last year, the film industry is expected to witness a boom," says Qi Yongfeng, a professor at Communication University of China.

Moreover, the culture industry shows a "counter-cyclical" feature, says Zhang Xiaoming, a researcher at the Chinese Academy of Social Sciences, which means people usually spend more on cultural products when the economy slows down.

People born after the 1970s are the major consumers of cultural products in China. Their entertainment priorities are changing from watching television to seeing movies on big screens. And the technological progress made by filmmakers - the use of 3D and IMAX, for example - is transforming the entertainment industry and thus drawing more young people, says Peng Kan, research and development director of Beijing-based media-research company EntGroup. This is laying a solid foundation for a sustainable market.

Chinese companies have also learned to make money from derivative products of films. For example, companies licensed to deal in derivative products, such as toys and theme park attractions, of Transformers 4: Age of Extinction expect to make good money after the record box office returns from the film.

China's Wanda Group, headquartered in Dalian, Liaoning province, acquired the AMC Entertainment Holdings Inc late last year. Wanda, one of the largest real estate companies and the largest cinema chain operator in China, paid $2.6 billion for the acquisition to become a world leader in cinema chain operation. It was also the first major international merger and acquisition deal struck by a Chinese company in the film industry.