Housing market measures will help

By Louis Kuijs and Tiffany Qiu (China Daily) Updated: 2014-10-08 08:07However, we do not expect this package to lead to a rapid recovery of the real estate sector. Unlike previous downturns in China's real estate sector, the current one is to a large extent market-driven. In a setting of lacklustre sentiment and sales momentum, housing prices have fallen and inventories of unsold housing have risen to sizeable levels. Housing sales may well see an improvement. However, we do not expect a quick return to sustained rapid housing sales growth. In particular, given the inventories of unsold housing and additional large volumes of housing in construction but not finished hanging over the market, we do not expect a decisive recovery in housing starts soon.

Nonetheless, in our view these measures are substantial enough to improve sentiment and sales on the property market. In particular, the first two measures should quickly have a significant impact. Also, the fourth measure, in such a formal policy document, should have material impact on bank lending to developers.

In the medium-term, we think fundamental demand for housing remains sizeable, driven by continued urbanization and household income growth, thus providing a floor under the market. Upshot for the overall growth-policy dynamics

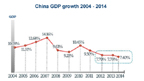

Adding up the current weak growth momentum, our view that many organic growth drivers remain intact even though they are not roaring and the leadership's relatively restrained approach to stimulus so far, we forecast 7.1 percent GDP growth in the second half of 2014, leading to 7.2 percent for the year as a whole. Factoring in continued downward pressure from real estate but with some respite from better global trade growth, we forecast GDP growth of 7.3 percent in 2015.

The authors are economists with the Royal Bank of Scotland.